US confirms 25% tariff on French imports in Digital Sales Tax retaliation

Following the launch of a Section 301 Investigation last year, the US Trade Representative has announced 25% tariffs on certain French products, starting January 6, 2021.

July 14, 2020

Following the launch of a Section 301 Investigation last year, the US Trade Representative has announced 25% tariffs on certain French products, starting January 6, 2021.

Tensions between the two countries have been building for some time, perhaps mirrored by a less favourable relationship between the two countries premiers. France’s Digital Sales Tax is fuel on the flames here.

While the Digital Sales Tax should be viewed as a reasonable approach to ensure companies pay fair taxes in the countries they realise profits, the White House has taken offense to the scheme, seemingly believing that US firms should be exempt from paying taxes in the international markets.

The Section 301 Investigation was officially launched on July 10, 2019, with the US Trade Representative accepting public comments on the potential to introduce tariffs on certain French imports, most notably wine and cheese. 3,795 comments were submitted, many of which are against the introduction of any tariffs.

“The enactment of this unilateral digital services tax represents a troubling precedent, unnecessarily departs from progress toward stable and sustainable international tax policies and will disproportionately impact US-headquartered companies,” Jennifer McCloskey of the Information Technology Industry Council states.

“The US restaurant industry has already been directly impacted by the current 25% tariffs on EU products,” said restauranteur Susan Cheslik. “The proposed increase of up to 100% tariffs on these products, in addition to newly proposed tariffs on sparkling wine and cheese from France, would cause disproportionate economic harm to Americas restaurants, 90 percent of those being small businesses.”

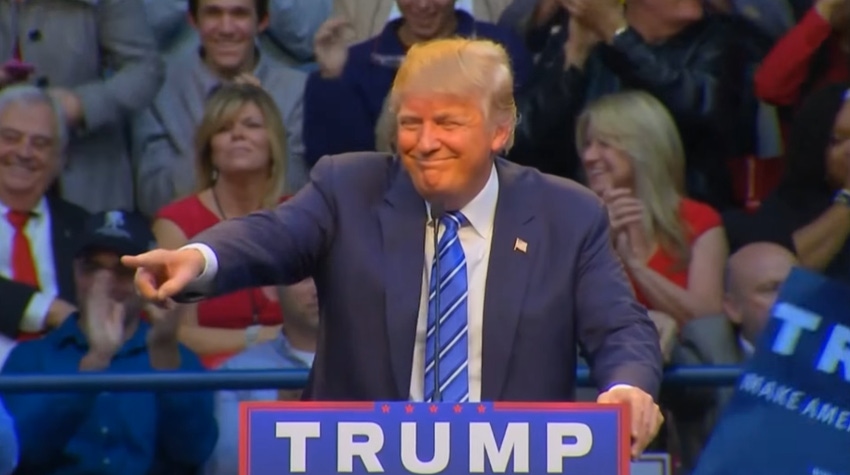

There are numerous other comments in opposition to the potential tariffs, though it is becoming increasingly common for political administrations to ignore the wants and needs of the general public. As Trump continues to attempt to run the US as a CEO not a President, a new brand of international relations is coming to the floor, one which is a lot less diplomatic.

The investigation has climaxed today. On January 6, 2021, the US Government will introduce 25% tariffs on a range of French products and services. The start date is in six months’ time to allow for negotiations between the two countries.

The issue at hand effectively boils down to taxation laws which were written for a previous era. In many countries, tax laws attempt to take a slice of profits, which was effective prior to the days of a globalised economy. As many companies are not domiciled in the countries they operate, taxes can be shifted to subsidiaries in more favourable regulatory climates. Silicon Valley has been doing this for years, effectively paying no tax on profits realised in various countries.

France and the UK are leading the charge to combat such tax avoidance strategies. By imposing a sales tax on revenues achieved in the country, in France it will be 3%, the theory is that it will be much more difficult for the companies to avoid as customers are physically located in the country.

For any reasonable individual, this would be seen as a fair and proportionate tax, but not those residing in Washington DC.

The US Government believes the tax is discriminatory against US companies, is contradictory to international tax standards as it is retroactive to January 1, 2019 and is unreasonable as it targets specific segments due to their commercial success.

The law does not target US companies, but any internet company which has of at least €750 million globally and €25 million in France. It is retroactive, though the companies in question were given adequate warning of the rules. And finally, it does not target successful companies, but closes unreasonable loopholes in tax laws which have been exploited by certain companies. These rules should have been updated years ago.

Interestingly enough, should this all sound very familiar that is because this is the same bureaucratic steps which were taken at the beginning of the trade war with China.

The Chinese Section 301 Investigation came to the conclusion that the Chinese Government was pressurising technology transfer from US companies, depriving US companies the opportunity to negotiate fairly, unfairly influencing investment and orchestrating cyberattacks directed towards the US.

Once this investigation came to the appropriate conclusion, the White House and the US State Department were given bureaucratic validation to exert pressure on the Chinese Government through the implementation of tariffs. The list of goods facing US tariffs has been widened on several occasions as the relationship between the two nations continued to deteriorate. As it stands, it does not appear there is any way for the two countries to come to an amicable agreement under current leadership.

The question which remains with the French is how much resistance the Government will offer. The UK Government attempted to oppose White House opinion on Huawei, but eventually caved to the on-going pressure (or so it would appear). The French do have a track record of resisting aggressivepoliticians so it will be interesting to see how the threat of 25% tariffs is received in Paris.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)