Consumers are weighing up the pros and cons of upgrading to 5G mobile services, but telcos have more to think about than simply persuading them to go for it.

December 15, 2020

Consumers are weighing up the pros and cons of upgrading to 5G mobile services, but telcos have more to think about than simply persuading them to go for it.

So claims the latest future-gazing report from GSMA Intelligence, which takes a broad look at the telecoms sector in the post-Covid-19 world.

The post-Covid message is for the most part positive; although the sector is inextricably linked to consumer fortunes, a gradual economic recovery in 2021 will support transformations in the network and in enterprise, such as the move to open RAN and digitisation, and new activity in consumer entertainment consumption. Further, the sector is proving more resilient to the pandemic than others; in higher-income countries the drop in telecoms revenue has been around half the decline in GDP.

Telcos may have successfully dealt with a sizeable increase in data usage on their networks as a result of the pandemic, which has also solidified the notion of telecoms as an essential service. But roaming revenues have taken a big hit, handset replacement figures are down, and consumers have less to spend due to the economic situation.

That will doubtless take its toll on 5G to some extent.

Despite Covid-19, operators are pushing on with 5G rollouts. According to GSMA Intelligence, 113 operators across 48 countries had launched 5G networks as of the end of September. Those operators together account for 40% of global mobile subscribers. Although 5G coverage is still nowhere near that level, that means there is a large addressable audience.

Uptake is a tricky calculation at present, with only four of those operators actually reporting figures, the GSMA’s analysts note. And the picture from those operators is mixed. “Adoption has reached 15% of the customer base in South Korea and is growing at 2 pp per quarter. NTT DoCoMo in Japan is the only other comparator but its take-up is much lower at 0.5%,” the report reads.

Consumer appetite for 5G has increased, but operators still have work to do to demonstrate the benefits of the technology.

According to the GSMA Intelligence report, 37% of people surveyed earlier this year in the US, Europe, Japan and Australia plan to upgrade to 5G, up from 19% in a year-ago study. Falling handset prices and marketing efforts have likely helped, it said.

“The survey was carried out before the new iPhone 12 was announced in October, which is the single biggest change factor. Can Apple generate a halo effect that extends beyond its own loyal and lucrative customer base?” the report asks. To which the most obvious answer is, you’re the analysts, feel free to take a punt…

The report’s comments on 5G gel with a similar publication from Ericsson last month, in which 25% of survey respondents across 17 countries said they planned to upgrade to 5G, with a major driving factor in certain key markets being the arrival of a 5G iPhone.

Clearly the handset is still king.

But while telcos have their work cut out persuading cash-strapped but increasingly connected consumers to make the move to 5G, they also have other avenues of growth to pursue in the year ahead.

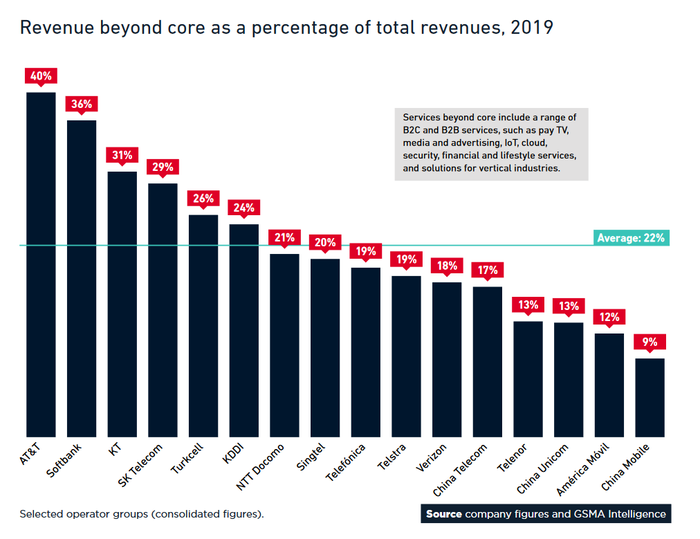

Services beyond core connectivity accounted for 20% of revenues for major telcos last year, GSMA Intelligence notes (see chart), up from 17% two years earlier, with operators like AT&T, Softbank, KT and SK Telecom leading the way. These revenues come from pay TV, media and advertising, IoT, cloud, security and financial services, amongst other areas.

“There’s no ‘one size fits all’ approach to growing revenue beyond core services,” the report states, highlighting AT&T’s big TV and media buys of the past few years; diversification efforts in Japan and South Korea; and China’s leading position in IoT and B2B solutions. “Turkcell is a standout exception; it has re-engineered itself into a digital telco,” the report states. “It provides one of the broadest portfolios of digital services.”

5G supports all or most of these diversification efforts, of course, with enterprise verticals standing out as an important target for telcos going forward. They will have a lot more to think about in 2021 than whether Joe Bloggs really sees the benefits of 5G services – hint: he probably won’t, unless he’s a gamer – or just wants a new iPhone.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)