AT&T spent big in US 3.45 GHz auction with Dish not far behind

US operator AT&T was widely tipped to be the biggest spender in last year's 3.45 GHz spectrum auction in the US and we now know that this was indeed the case.

January 17, 2022

US operator AT&T was widely tipped to be the biggest spender in last year’s 3.45 GHz spectrum auction in the US and we now know that this was indeed the case.

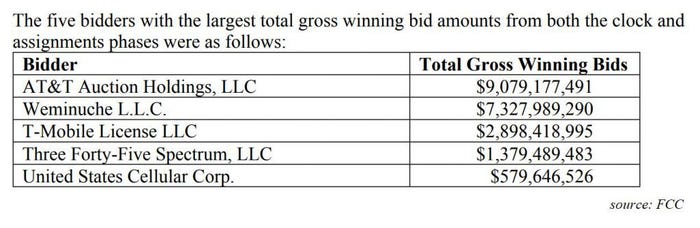

The regulator finally shared the names of the winning bidders and the amounts pledged for spectrum following the conclusion of the assignment phase of the auction. The high-value clock phase ended in November, with bidders having committed US$21.89 billion to the cause, while the assignment phase, which ran until early January, added just half a billion; the final total comes in at $22.5 billion.

But the interest lies less in the overall spend than in who is responsible for it.

The FCC lists AT&T as the top bidder, with 1,624 licences at a cost of $9.1 billion, while Dish – bidding as Weminuche (see chart) came in second with a spend of $7.3 billion for 1,232 licences. T-Mobile’s investment is somewhat lower – it is paying $2.9 billion for 199 licences, focusing on major markets – while Verizon does not feature among the big winners…or indeed among the winners at all; it was registered to participate, but clearly did not.

We knew what was coming as far as AT&T is concerned. The operator needed mid-band spectrum and it made sure to secure as much as it could, within auction limits.

“This pickup could be a game changer for AT&T as it only won 40 MHz of the A-block in the C-band auction,” noted spectrum specialist and BitPath COO Sasha Javid, in a blog post. The additional 40 MHz won in this auction combined with the 40 MHz of A blocks won in the C-band auction could actually give AT&T a better mid-band 5G offering for the next two years.”

As an aside, the A block frequencies in the C band were supposed to be available for use from late last year, but AT&T and Verizon are still being forced to delay 5G launches using those airwaves due to their ongoing conflict with the aviation industry, which claims the new mobile technology could interfere with airline systems.

While AT&T picking up plenty of spectrum in auction 110 came as no surprise, Verizon’s decision not to participate at all was slightly unexpected, although given that it racked up a bill of almost $53 billion including clearance costs in the much-hyped C-band sale, it’s hardly a shock. Dish’s $7 billion-plus send triggers a sharper intake of breath though.

The telco – as it can almost now be described – has been sitting on a spectrum pile for years and is only now rolling out its own 5G network…which has not yet launched commercially. It seemed unlikely that Dish would look to significantly boost its spectrum coffers at this auction, and at this stage its reasoning for doing so is not entirely clear.

Dish’s auction spend “is a big number and far more than I (or anyone) predicted,” Javid said. Or to put it another way, “Dish once again came to the FCC’s rescue spending big in this auction,” he said, adding that auction 110 was the third biggest ever in the US. That makes it “a nice win early in the term,” for FCC chair Jessica Rosenworcel, who was named as the permanent holder of the post in October.

For her part, Rosenworcel published a standard regulator comment on the matter.

“Today’s 3.45 GHz auction results demonstrate that the Commission’s pivot to mid-band spectrum for 5G was the right move,” she said. “I am pleased to see that this auction also is creating opportunities for a wider variety of competitors, including small businesses and rural service providers.”

But let’s face it, all people really want to know at this stage is what the big guns splashed out.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)