Romania 5G auction finally finishes but falls flat

Romania has completed the sale of spectrum suitable for rolling out 5G services after lengthy delays, but the process did not raise as much as the government might have hoped.

November 16, 2022

Romania has completed the sale of spectrum suitable for rolling out 5G services after lengthy delays, but the process did not raise as much as the government might have hoped.

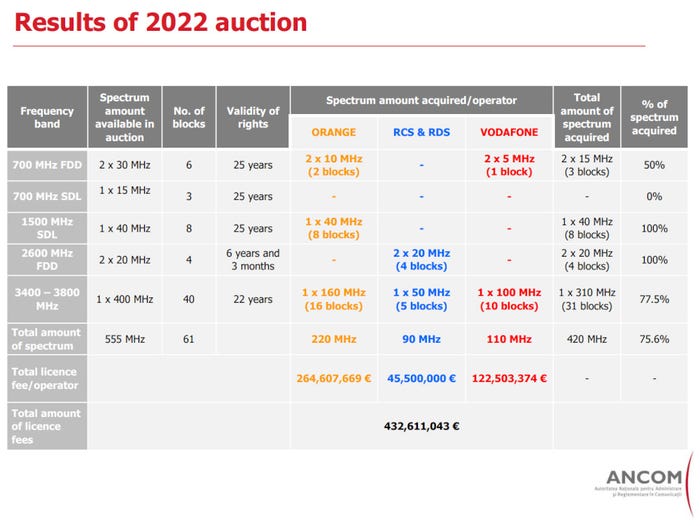

The three participants – Orange, Vodafone and Digi – together pledged €432.6 million for 420 MHz of frequencies in the 700 MHz, 1500 MHz, 2600 MHz and 3400 MHz-3800 MHz bands, regulator ANCOM disclosed, which was some way short of the full amount of spectrum the country had put up for sale.

The telcos picked up 76% of the available frequencies, with Orange securing the lion’s share. The Romanian market leader spent €264.6 million on 220 MHz of spectrum in three of the four bands (see chart), while Vodafone’s spend was less than half that, and Digi (also known as RCS & RDS) brought up the rear.

The market’s fourth mobile network operator, the Deutsche Telekom-owned incumbent, chose not to participate in the auction.

Tongues have been wagging in recent weeks about the telco group’s absence and on Tuesday local news outlet Economica.net quoted ANCOM president Vlad Stoica as suggesting that it could be linked to its indecision over its future in the market. The telco’s shareholders have yet to reach consensus on a sale and as such it did not take part in the frequency allocation process, he surmised.

That looks like a decent educated guess. Deutsche Telekom’s presence in Romania has been the subject of debate for a number of years.

As has the spectrum auction itself. The process has been subjected to endless delays dating back at least three year, mainly due to the legislation surrounding it, or indeed lack thereof. The US-led crusade against Chinese equipment makers also proved to be a sticking point while the sale was being organised, and the operators themselves requested changes to the T&Cs of the auction, some of which the regulator granted, such as reducing coverage obligations and – crucially – annual licence fees.

Speaking of China, Economica.net also cited Stoica and his vice president Bogdan Iana as speculating that Vodafone’s auction spend was lower than that of its major rival because it has the greater exposure to the ban on Chinese equipment. It has hefty investments to make in replacing Huawei kit, which could explain its reluctance to shell out for more spectrum, they said, while noting that the telco picked up a fair number of frequencies and is clearly committed to its Romanian 5G rollout.

Funnily enough, there was no official comment on that from Vodafone. Orange though was all too happy to talk about the auction result.

“We have made a significant investment to offer customers, the business environment, central and local administrations, but also researchers, an Orange network prepared for the challenges brought by the digital transformation of the next 25 years.” said Liudmila Climoc, CEO of Orange Romania.

The telco’s 5G network in the country now covers 20 cities, while it claims north of 98 percent population coverage with 4G. It will use the newly-acquired spectrum to increase mobile coverage and quality in rural and urban areas, it said.

While Orange won the biggest share of the spoils at this auction, there will be another opportunity for its rivals to pick up more frequencies in future, given that not all were sold this time around.

Indeed, while the regulator is keen to put a positive spin on the €433 million it raised, the €693 million reserve price would surely have been a more palatable sum.

ANCOM’s Stoica described the auction as “a good result,” given the current macroeconomic and political climate, according to a separate report from Economica.net.

“It was not easy,” he said, highlighting the regulator’s need to collaborate with the government and broader society to get the auction over the line.

“The total value of the spectrum that we auctioned was 693 million euros. Historically speaking, we have never stated that we expect to sell all spectrum. This has never happened in Romania,” he said.

That may well be true. It was certainly the case when the country sold off its last swathe of airwaves this time last year. But it still smacks of a certain amount of spin.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)