5G FWA growing faster than expected – Ericsson

Ericsson is sticking to a recent prediction that 5G customer numbers will top the 1 billion mark by the end of the year, but has increased its forecast for fixed wireless access (FWA) subscriptions.

November 30, 2022

Ericsson is sticking to a recent prediction that 5G customer numbers will top the 1 billion mark by the end of the year, but has increased its forecast for fixed wireless access (FWA) subscriptions.

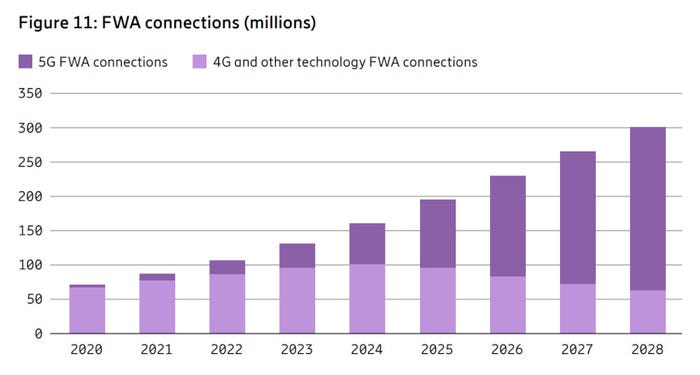

5G FWA customer numbers will remain fairly low this year; we’re looking at around 30 million or so (see chart) out of a total FWA base of just over 100 million, according to the Swedish kit vendor. However, total global FWA subscriptions will grow at 19 percent year-on-year during the 2022 to 2028 period to reach more than 300 million by 2028, the vast majority of which will be based on 5G.

The use of FWA for home and even business broadband is proving to be a major early use case for 5G, especially in regions where the fixed broadband market is lacking. FWA growth is in part driven by India and will also come in other emerging markets, Ericsson notes in the most recent version of its Mobility Report. Its data shows that almost 40 percent of 5G FWA launches came in emerging markets in the past year, with services now on offer in densely populated countries like Mexico, South Africa and the Philippines.

“Following the 5G spectrum auction in India in July, a major service provider has expressed a goal to serve 100 million homes and millions of businesses with 5G FWA services,” Ericsson stated. It is, of course, talking about Reliance Jio, although it is unclear why it chose not to name the company.

“Higher volumes of 5G FWA in large high-growth countries such as India have the potential to drive economies of scale for the overall 5G FWA ecosystem, resulting in affordable CPE that will have a positive impact across low-income markets,” the vendor added.

5G has only just come to market in India; its big operators launched services in early October. But operators are rolling out the technology at pace and with the price of 5G smartphones coming down, customer numbers will go up. 5G subscriptions in the India region – which includes Nepal and Bhutan – should reach 31 million by the end of this year and 690 million by end-2028, accounting for more than half of all mobile subscriptions – 1.3 billion – by that date.

Globally, 5G subscriptions will hit 5 billion by the end of 2028, Ericsson predicts, despite the economic challenges much of the world is facing.

Service providers together added 110 million 5G subscriptions in the July-September period, bringing the worldwide total to around 870 million. With that sort of uptake, the 1 billion by year-end figure looks comfortably attainable, and will come two years earlier than the same milestone following the launch of 4G. Growth is being driven by device availability, falling prices and large-scale deployments in China, Ericsson said.

It added that North East Asia as a whole and North America are witnessing strong 5G growth, with penetration in those markets likely to reach around the 35 percent mark by the end of this year. Given that the world’s first 5G launches came in the US and in Korea back in 2019, it makes sense that those areas are leading the way in terms of uptake.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)