US pays top dollar for mobile data, but UK gets a fair deal

The cost of mobile data is still pretty high in the US, but on this side of the pond customers are getting a much better deal, according to new research published on Tuesday.

September 26, 2023

The cost of mobile data is still pretty high in the US, but on this side of the pond customers are getting a much better deal, according to new research published on Tuesday.

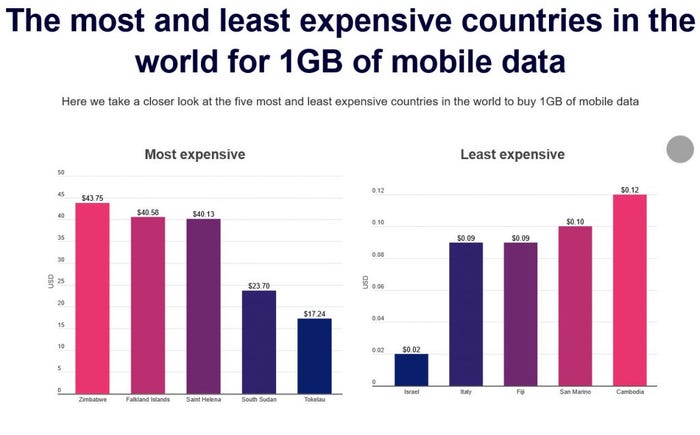

The US ranks 219th in the world when it comes to purchasing mobile data, Cable.co.uk claims in its latest worldwide mobile data pricing report. The average cost of 1 GB of mobile data comes in at US$6.00 stateside, which is way above most other nations, particularly the more developed ones. The bottom of the ranking – there are 237 countries included in all, which puts the US way off the pace – is mainly populated by less developed nations and small island groups, as you might expect.

However, the US is not the only outlier. The pricey end of the mobile data table also includes South Korea, Canada and New Zealand in 214th, 216th and 218th places respectively – Canadians have been complaining about high prices for years, despite the authorities’ insistence that market competition is healthy – and Switzerland at 226th, thanks to an average cost for 1 GB of data of the equivalent of $7.29.

The very bottom spot in the table belongs to Zimbabwe, where 1 GB of data costs $43.75, making it just a few dollars more expensive than the Falkland Islands and Saint Helena, both of which came in at above $40.00.

At the other end of the scale, Israel is the cheapest market in the world, mobile customers being able to pick up 1 GB of mobile data for just $0.02.

Italy, where market competition has been fierce in recent years, in no small part as a result of the arrival of aggressive fourth player Iliad in 2018, ranks second at $0.09. It’s also worth noting that France comes in ninth ($0.20), China 28th ($0.38), Australia 39th ($0.44) and Spain – where consolidation could be on the cards – 42nd ($0.48).

The UK ranks in 58th place, 1 GB of mobile data costing $0.62. That feels like a reassuringly balanced position, although doubtless mobile operators would like to charge more for their wares and consumers are always in search of a better deal.

And in most cases, the balance between those two positions is that customers are getting more data for their money.

“Our yearly mobile data pricing tracking study is as much a measure of the quantity of data offered as it is the price of data more broadly. After all, those countries with the most improved (cheaper) pricing across the five years our tracker now covers tend to be those offering tens or even hundreds of times more data in 2023 as was available for similar money in 2019,” said Dan Howdle, consumer telecoms analyst at Cable.co.uk, in a statement accompanying the study.

“It’s encouraging to see the price of data coming down across the globe as whole, with the vast majority of countries offering 1 GB of mobile data for less than $2.00. It’s a very different picture to the one we saw in 2019,” he added.

The UK has certainly seen some changes since the firm’s 2019 report. Back then it ranked 136th in the world, 1 GB of data costing $6.42, and we were talking about it as an expensive market compared with much of the rest of Europe. As we have seen, some of the major European economies still have much lower prices than the UK, but the difference is much less stark.

Interestingly, India was the cheapest market in the world five years ago, with 1 GB of data being priced at an average of $0.26. It now ranks seventh, the price having fallen to $0.16, which is a less significant change than in many other markets.

In the US, for example, the price has more than halved from $12.37, which in 2019 put it at 145% of the global average. This year the worldwide average price for 1 GB of data has fallen to $2.59 and the US data price stands at 232% of that figure.

Customers should arguably be looking to get more bang for their buck.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)