Ericsson treads water in choppy Q1 seas as it relies ever more on IndiaEricsson treads water in choppy Q1 seas as it relies ever more on India

Growth remained elusive for Swedish kit vendor Ericsson in the first quarter of this year, while a geographic shift to India depressed margins.

April 18, 2023

Growth remained elusive for Swedish kit vendor Ericsson in the first quarter of this year, while a geographic shift to India depressed margins.

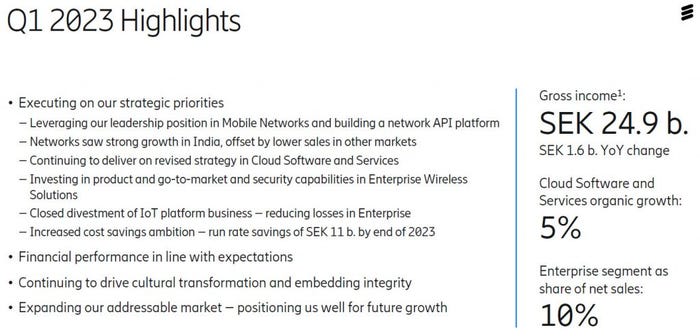

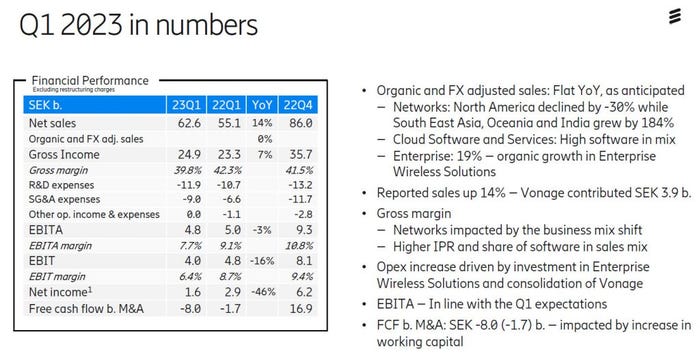

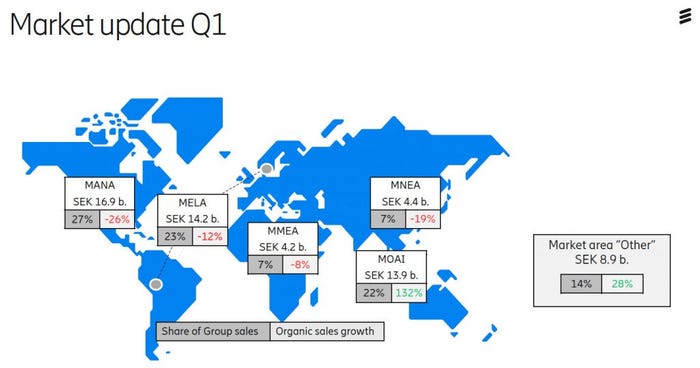

The top-line number was that overall sales were once more flat, year-on-year. The decline in US sales increased, as operators there dialled back their capex spend even more, but this was largely offset by India, where Ericsson has major deals with Jio and Bharti Airtel. However, this increasing reliance (no pun intended) on India had a negative effect on profitability, with EBITA margin sinking to 7.7%.

“As expected, customers in early 5G markets have slowed the deployment pace somewhat,” said Ericsson CEO Börje Ekholm. “Our effect on sales is bigger as some customers have also lowered the elevated inventory levels built up in a tight supply environment. We expect this inventory adjustment to be mostly completed during Q2 but may spill into Q3.

“Following the strong cash flow in Q4, the first quarter cash flow was negative. Compared to last year working capital grew related to the changed business mix with the two components: increased customer financing for large roll-out projects in new 5G markets and reduced trade payables. As usual, Q1 cash flow was seasonally impacted by pay-out of accrued employee-related expenses.”

So it seems that Ericsson not only takes a margin hit with Indian customers, it also has to offer them generous financing options. That plunge in cash flow must be a cause for concern, especially as the year-on-year comparison shows only a small amount of it is down to seasonality. Maybe that was a contributing factor for the decision of CFO Carl Mellander to hand in his notice, although he will hang around for another year.

“Ericsson is well positioned globally to continue building on its industry-leading position and to expand into enterprise,” said Mellander. “If there was ever a good time for me to move on to new career adventures, I feel that this moment is it, and I am excited about what the future might bring. Meanwhile I will continue in full capacity as CFO during this period. I will always follow Ericsson with passion and pride as it keeps transforming society.”

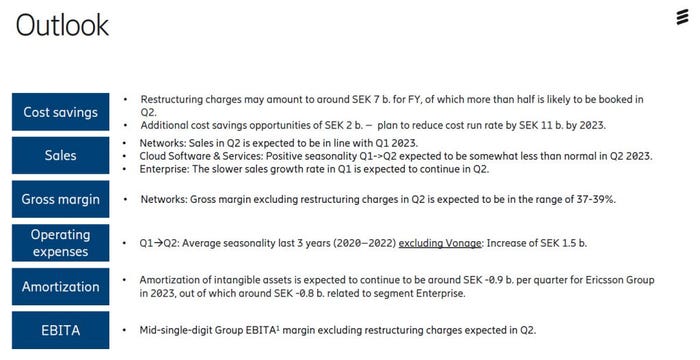

Ericsson still reckons its EBITA margin will hit at least 15% by 2024 but it seems moving in the wrong direction right now. A lot of this will depend on the US starting to spend again which, in a phone interview with Telecoms.com, Ericsson Head of Networks Fredrik Jejdling indicated he was optimistic about, as rapid traffic growth requires continued investment to support. The latest round of job cuts should also have a significant positive impact once they are complete.

“We continue to see a choppy environment during 2023 with poor visibility,” concluded Ekholm. “In Q2, we expect operators to remain cautious with capex investments and continue to adjust inventories. We expect this dynamic to largely be offset by growth from large roll-out projects which, as noted earlier, will be dilutive to gross margin in the short term.

“Our strategy is paying off and we are excited about our position to capitalize on the full value of 5G. We are driving our transformation to a platform company with a focus on creating a stronger and more profitable Ericsson with a larger addressable market.”

Ericsson’s shares were down around 7% at time of writing, erasing gains over the past month. Jejdling was on his way back from Canada, following another R&D investment announcement there, when we spoke to him, and the company continues to play the long game in its quarterlies. It doesn’t have much of an alternative in the current economic climate but investors will expect to see a significant inflection point before the end of this year.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)