Nokia reveals its new cunning plan: wait for 5GNokia reveals its new cunning plan: wait for 5G

Nokia has had its first investor day four two years and the underlying message was not to expect much growth any time soon.

November 15, 2016

Nokia has had its first investor day four two years and the underlying message was not to expect much growth any time soon.

The company was keen to infer it’s in better shape than some of its competitors but the underlying strategy seemed pretty similar to Ericsson’s: get the core business back on track while trying hard to diversify away from it and at the same time cut costs. Nokia seems to think its licensing business has some long term potential too.

“Nokia is extremely well-positioned to win in its primary market with communication service providers, and we aim to target superior returns through focused growth into more attractive adjacent markets where high-performance, end-to-end networks are increasingly in demand,” said Nokia CEO Rajeev Suri.

“We also see opportunities to renew current patent licensing agreements at favourable terms, add new licensees in the mobile phone area and expand licensing further into new areas such as consumer electronics and the automotive sector. Given the appeal to others of our innovations in Networks, virtual reality and digital health, we are confident that we can continue to build our patent and technology licensing business further in the coming years. Simultaneously, we will remain focused on flawlessly executing our €1.2 billion cost saving program.”

The thing is Nokia is openly admitting its numbers won’t be great in 2017, but is blaming this on weak operator demand for infrastructure kit. The hope is that once 5G starts to get real in 2018 all this pent-up demand will be unleashed and it will be party time again. While this is a laudably honest assessment of its current situation, sitting tight and waiting for things to get better isn’t the most cunning strategy we’ve ever encountered.

The day was an unrelenting marathon of PowerPoint presentations, but here are a few of the key slides.

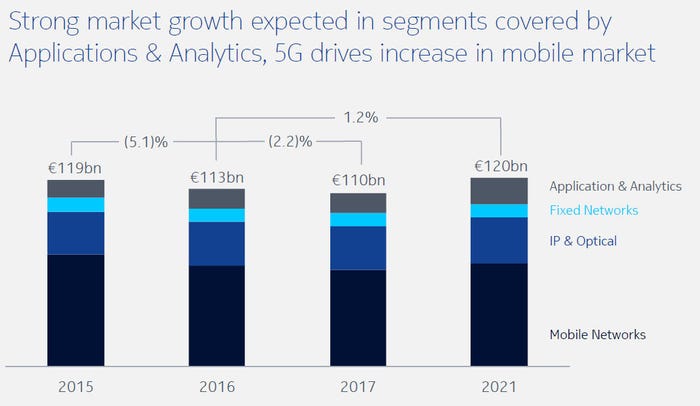

Back to growth by 2021 in primary market

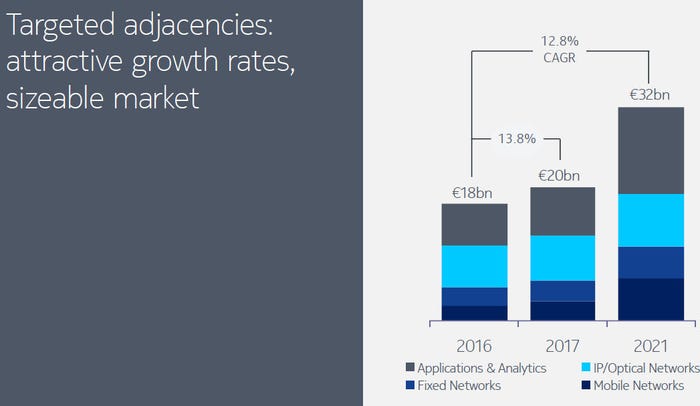

Extending core offerings to new verticals other than CSPs

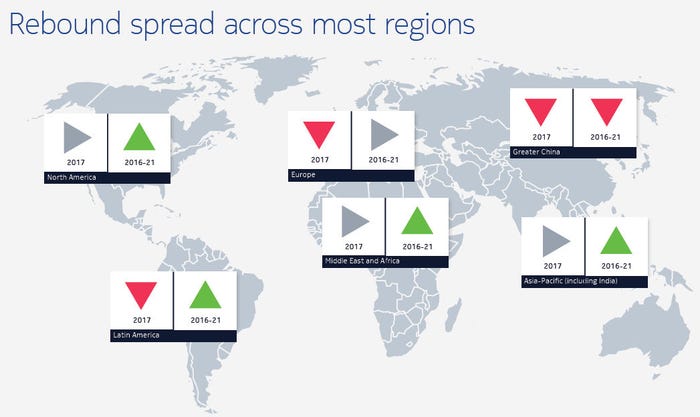

Not looking so good for growth in Europe and China

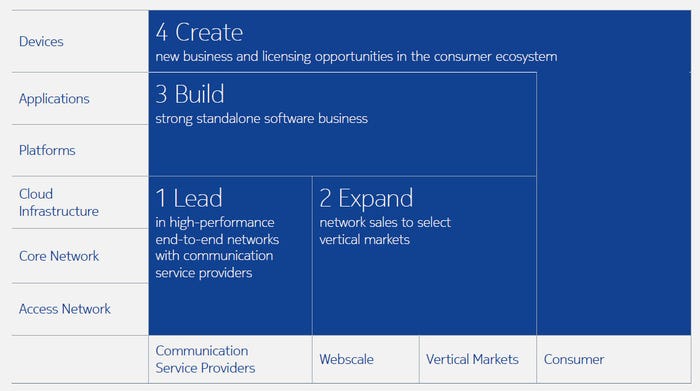

Nokia’s version of the Ericsson strategy slide

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)