Nokia’s margin took a hit last quarter but not as much as Ericsson’sNokia’s margin took a hit last quarter but not as much as Ericsson’s

For the first time we can remember Nokia and Ericsson reported their quarterly numbers at the same time, and Nokia’s were a bit better.

October 20, 2022

For the first time we can remember Nokia and Ericsson reported their quarterly numbers at the same time, and Nokia’s were a bit better.

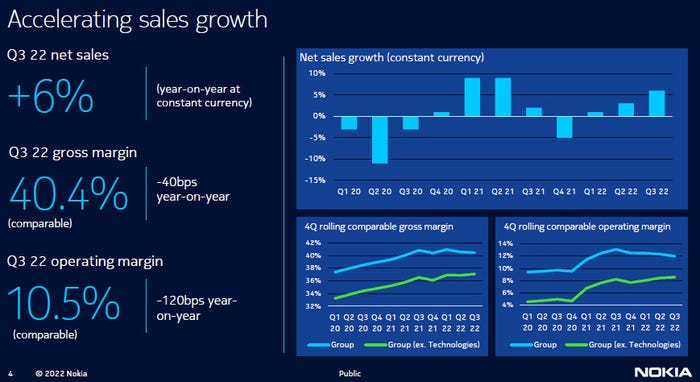

Nokia’s net sales are up a healthy 6% when adjusted for adjustments, but it seems investors were more interested in the loss of a percentage point of margin and a cautious outlook, as Nokia’s share price had fallen by 8% at time of writing. That still represented a better performance than that of its main competitor, Ericsson, which is increasingly testing the patience of its investors.

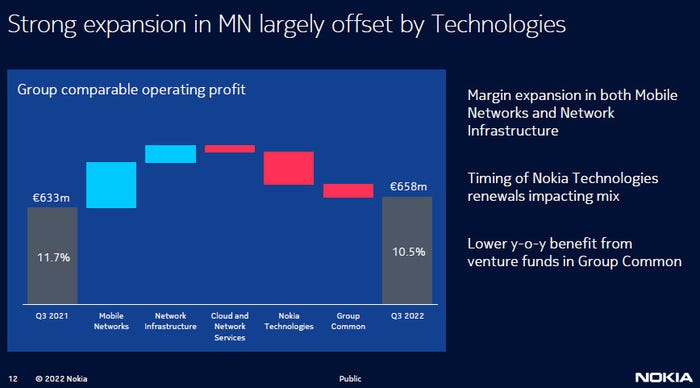

Our third quarter performance demonstrates we are delivering on our ambition to accelerate growth,” said Nokia CEO Pekka Lundmark. “Net sales grew 6% in constant currency as supply constraints started to ease and we maintained good profitability with comparable operating margin of 10.5%. This was slightly down year-on-year, as improving profitability in Mobile Networks and Network Infrastructure was offset by timing effects of contract renewals in Nokia Technologies.

“While risks around timing of outstanding deals in Nokia Technologies remain, assuming these close we continue tracking towards the high-end of our net sales guidance for 2022 and towards the mid-point of our operating margin guidance.

“As we start to look beyond 2022, we recognize the increasing macro and geopolitical uncertainty within which we operate. While it could have an impact on some of our customers’ capex spending, we currently expect growth on a constant currency basis in our addressable markets in 2023. Considering our recent success in new 5G deals in regions like India which are expected to ramp up strongly in 2023, we believe we are firmly on a path to outperform the market and to make progress towards achieving our long-term margin targets.”

This increasing macro and geopolitical uncertainty is likely to be the elephant in the room for all earnings announcements for the foreseeable future. With that in mind the hit to Nokia’s shares after fairly solid numbers seems a bit harsh, but it’s unlikely to be the last example of investor skittishness this year. Maybe the Nokia earnings video will cheer them up a bit

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)