Lumen offloads consumer ops for $7.5 billionLumen offloads consumer ops for $7.5 billion

Lumen has brokered a US$7.5 billion deal with Apollo Global Management that will see it part with its legacy consumer operations in 20 states across the Midwest and Southeast of the US.

August 4, 2021

Lumen has brokered a US$7.5 billion deal with Apollo Global Management that will see it part with its legacy consumer operations in 20 states across the Midwest and Southeast of the US.

Following rumours to that effect a few weeks ago, Lumen confirmed that it has reached agreement with the asset manager to sell a sizeable chunk of the old CenturyLink business that offers services to consumers and small businesses mainly via DSL.

The US telco adopted the Lumen brand in September last year, as part of a push to reposition itself as a provider of enterprise solutions and services in new technological areas like the Internet of Things (IoT), robotics, collaboration and automation. It retained its former brand, CenturyLink, for legacy connectivity services, and created Quantum Fiber, which, as the name suggests, provides consumer and small business services over fibre infrastructure. It was pretty clear then that CenturyLink’s time was running out, at least as far as Lumen was concerned.

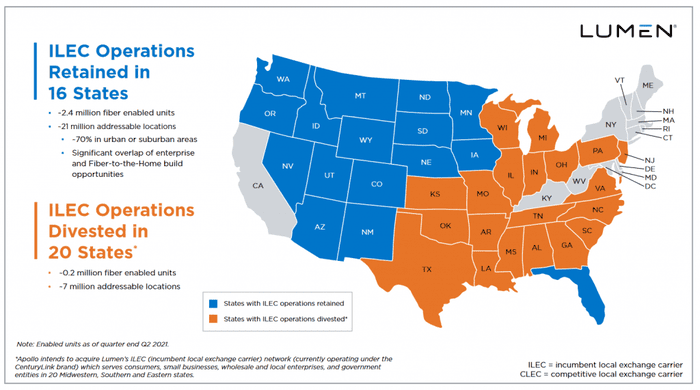

That is partly true. Lumen is selling its CenturyLink-branded incumbent local exchange carrier (ILEC) business – which covers consumer, small business, wholesale and mostly copper-served enterprise customers – in 20 states for the aforementioned $7.5 billion, including debt assumption of around $1.4 billion. The operations include around 7 million addressable locations and approximately 200,000 fibre-enabled units (see chart). However, it is retaining its ILEC operations in 16 states, plus its national fibre routes and competitive local exchange carrier (CLEC) networks in all 36 states in its footprint.

“This transaction is an important step in our continued efforts to transform Lumen and drive future growth for our company,” said Lumen chief executive Jeff Storey. “We are pleased with the attractive valuation we received for these assets, which highlights the overall value of Lumen’s extensive asset portfolio. Apollo Funds will receive a great business with a strong customer base, dedicated employees, and a platform for future growth.”

What the company is essentially saying is that it believes the assets it is selling are still highly valuable, but its priorities lie elsewhere, a conviction that appears to be substantiated by Apollo’s willingness to pay billions for them.

The deal implies an enterprise value of around 5.5x estimated adjusted EBITDA for the most recent financial year.

The Apollo deal comes just days after Lumen inked a $2.7 billion deal with hedge fund Stonepeak for its Latin American operations.

That’s north of $10 billion in non-core asset sales in just over a week, and it’s not wholly clear at this stage whether there are more to come. Lumen is not ruling anything out. It noted that it expects the transaction to be “roughly leverage neutral,” which suggests this is about reshaping the Lumen business more than it is about debt-reduction or similar. As such, more M&A of one sort or another could well be on the cards.

For now, the companies are working towards closing the deal, which is expected to take place in the second half of next year, subject to the usual closing conditions and regulatory approvals.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)