Nokia reports a strong Q2 21 on the back of fixed-line infrastructure growthNokia reports a strong Q2 21 on the back of fixed-line infrastructure growth

All the indicators are moving in the right direction for Finnish kit vendor Nokia, which saw its share price jump after announcing its Q2 2021 numbers.

July 29, 2021

All the indicators are moving in the right direction for Finnish kit vendor Nokia, which saw its share price jump after announcing its Q2 2021 numbers.

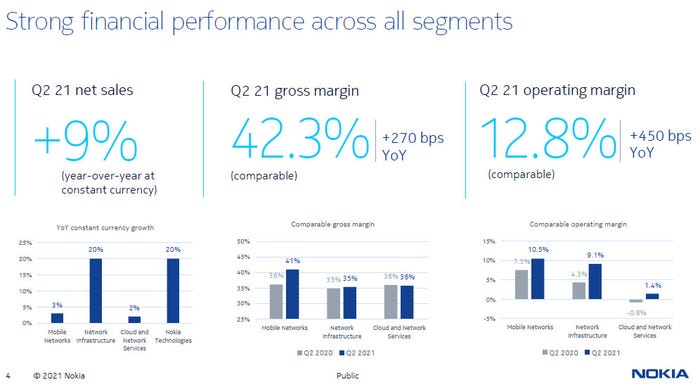

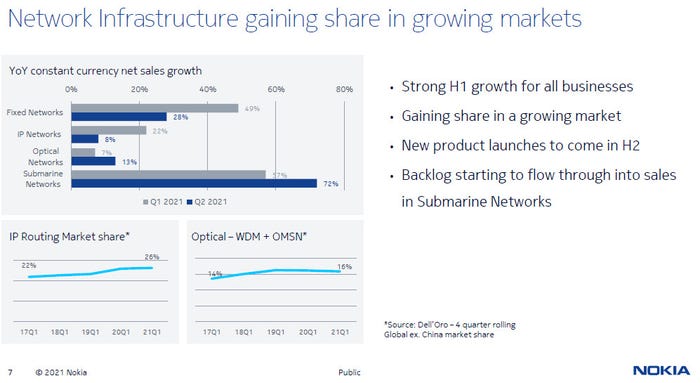

Sales were up 4% year-on-year, but once adjusted for adjustments that increase jumped to 9%. Gross margin was up nearly three percentage points and consequently Nokia’s profitability continued its dramatic recovery. The dominant contributor to all this financial exuberance was the fixed-line bit of the business, which finally seems to be up to full speed after the difficult Alcatel Lucent integration.

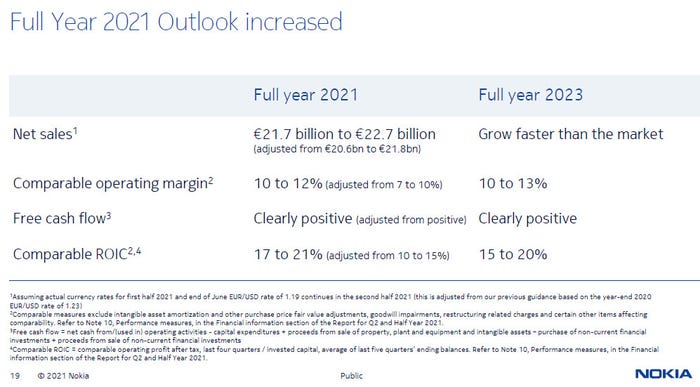

“Considering our robust start to 2021, we are revising upwards our full year Outlook,” said Nokia CEO Pekka Lundmark. “We now expect a comparable operating margin between 10-12% for full year 2021, compared to our previous range of 7-10%. We have executed faster than planned on our strategy in the first half which provides us with a good foundation for the full year.

“We still however expect to face the earlier communicated headwinds in the second half, particularly with market share loss and price erosion in North America. Therefore, we still expect our typical quarterly earnings seasonality to be less pronounced in 2021. In addition, we continue to accelerate R&D investments and monitor risks around component availability, considering the strong demand for our products.”

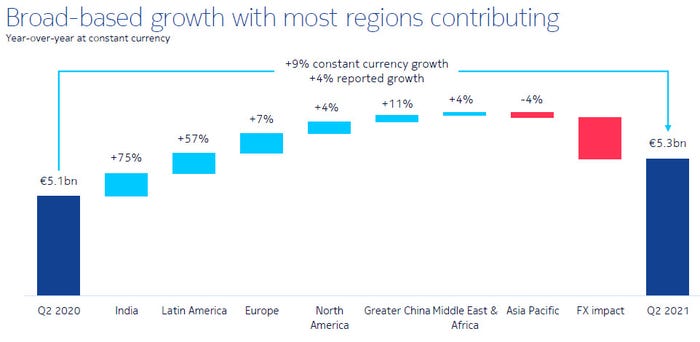

In other words, it’s great to be headed in the right direction but let’s not get carried away. The outlook upgrade was teased a couple of weeks ago, but Nokia’s shares were up 6% nonetheless. In the regional split it’s interesting to note the 11% growth in China, which presumably doesn’t include the recent China Mobile 700 MHz tender, so could get even better. Lundmark must be crossing his fingers that Finland doesn’t do anything to upset the Chinese Communist Party.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)