Energy service companies in the Telecoms sector: Emerging Markets

The mobile networks in Africa have grown beyond the reach of grid electricity and mobile operators have deployed a significant part of their tower infrastructure in areas without any access to grid electricity infrastructure….Energy Service Companies will take the responsibility by handling power system investment and daily activities for Mobile Network Operators in exchange for a fee. [1]

April 14, 2015

Telecoms.com periodically invites expert third-party contributors to submit analysis on a key topic affecting the telco industry. In this article, Mike Conradi, a partner at DLA Piper, discusses the energy challenges for the telecoms sector in emerging markets.

The mobile networks in Africa have grown beyond the reach of grid electricity and mobile operators have deployed a significant part of their tower infrastructure in areas without any access to grid electricity infrastructure….Energy Service Companies will take the responsibility by handling power system investment and daily activities for Mobile Network Operators in exchange for a fee. [1]

An Energy Service Company (ESCO) is a commercial structure that has been created to manage, supply and produce the local delivery of energy to an area or development. [2] The aim is to provide power at the same or higher level as originally provided, but at a lower cost and in a more energy-efficient manner.

ESCOs represent a very exciting innovation in the development of the telecoms sector in emerging markets, especially in areas where, typically, there is no electricity grid infrastructure. At present, mobile operators in these regions need to spend a large amount of effort, and resources, in arranging power supply (typically diesel) for their base stations. In fact the powering of telecom sites in Africa may constitute as much as 40% of the overall operating expenses for a mobile operator [3]. The concept of an ESCO is, fundamentally, to allow the mechanics of power generation to be outsourced to specialists. An ESCO can allow the mobile operators to act almost as if there were a grid, and even to pay for their power in just the same way (on a per kilowatt-hour basis).

ESCOs are reasonably well established in mature markets worldwide, but have rarely been used in the telecoms sector. Their success in creating services such as high efficiency variable flow pumps and heat systems has paved the way for companies to begin to see the value that ESCOs could offer to the telecoms industry in emerging markets. This has created excitement – innovation surrounding ESCOs in the telecoms sector is developing rapidly, with research and development at an all-time high as the need for these services becomes more apparent.

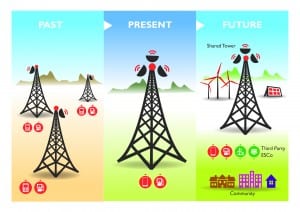

In the past, in the telecoms industry (see ‘Past’ in the diagram below), individual mobile operators managed their own towers forming their own network. This was not the most efficient method of providing mobile services and in order to improve efficiency and reduce costs in many places worldwide operators have set up “tower companies”, either as joint ventures or independent entities, to share their Radio Access Networks (RAN) – effectively reducing the infrastructure needed by sharing single towers between multiple operators (see ‘Present’ in the diagram below). However, though an improvement in terms of efficiency this set –up still requires each tower, typically, to have its own power-generation infrastructure – often diesel generators, diesel storage facilities, guards and logistics. The is power then has to be run inefficiently – often with the generators going at all times regardless of utilisation as the operators are unable to predict consumer use.

By contrast the ESCO can take control of the supply of power to mobile infrastructure in an area, can use cleaner more renewable technology and can (often) use surplus power to supply homes and businesses in the area. ESCOs can provide an invaluable service to the environment and consumers by ‘finding and implementing self-financing energy savings opportunities, which reduce energy waste, emissions and save costs’.[4]

Figure 1: Telecoms Infrastructure Past, Present And Future

Companies are now beginning to see the benefit that ESCOs can provide. In Africa, for example, where national grid availability is limited and unreliable, ESCOs could play an instrumental role in expanding the telecommunications networks as they offer to maintain all power generation equipment as well as take the risks involved with all elements of power supply . As specialist companies, their experience allows for increased electrical and management efficiencies, resulting in reduced costs financially and environmentally to the surrounding environment.

Business Models

In a recent article entitled “Tower Power Africa: Energy Challenges and Opportunities for the Mobile Industry in Africa” [5], three business models commonly used in the telecoms industry were identified. These models are known as:

A Power Purchase Agreement Model;

A Monthly Flat Fee model; and

An Energy Saving Agreement Model.

A Power Purchase Agreement (PPA) Model is a model whereby the ESCO acts almost as if it were as a national grid, taking all responsibility for the organisation of the power in the area. The Mobile Network Operator (MNO) buys energy from the ESCO based on a kilowatt-hour price (perhaps with minimum commitment). Here, though, the ESCO has less of an incentive to reduce the amount of kilowatt-hours taken as they are charging their fee on the basis of usage.

A Monthly Flat Fee (MFF) Model appears to be a more energy efficient model and one that may deserves more attention in emerging markets. In this model, a monthly fixed fee is agreed between the ESCO and the MNO which the ESCO receives for managing and providing all the MNO’s energy requirements. Here the ESCO receives a much greater incentive to reduce the number of kilowatt-hours that are used – and any surplus power be sold to the local community. Moreover more efficient use of power may, in more developed markets, allow the ESCO to claim government subsidies connected with ‘green’ developments.

The risk with an MFF model is that it assumes a fairly stable, or at least predictable, usage pattern. This will not naturally accommodate an unexpected influx of customers onto the mobile network, or a change in their usage patterns. To counter this risk parameters must be in place in the contract to ensure that if usage deviates significantly from what was foreseen then the ESCO will receive additional payments. Alternatively some degree of mitigation could be achieved by charging for power on a “per subscriber” basis, or even on the basis of volumes of minutes, SMS and data transmitted. Similarly, the MFF model may need to be flexible enough to take into account inflation or fuel prices.

An Energy Saving Agreement (ESA) Model allows the ESCO and the MNO to work closely together in order to monitor the energy that is saved as a result of the power infrastructure investment made. A monetary figure will be calculated to reflect these savings and this will then be split between both the MNO and the ESCO. Here, both parties have an incentive to create a system that is as energy efficient, and therefore as cost effective, as possible. Whilst this sounds like an attractive model, this may not, in practice, be the most appropriate method to use in emerging markets. The calculation of saved energy could be problematic in locations where proper monitoring systems have not yet been installed. Moreover typically tower companies are happy to take on capital expenditure onto their own books so a model like this – which removes capex and replaces it with opex – may not in fact be that attractive to tower company customers. For this reason the ESA model is more likely to be of interest to MNOs directly.

Market Dynamics

In respect of market dynamics the concern about ESCOs is the monopoly they may come to hold over the local power market. The ESCO will supply all energy and may therefore be in a position to abuse its power. However it may be expected, at least in many cases, that the countervailing power enjoyed by the MNOs/tower companies, as very large “anchor” customers for the ESCO, will operate to mitigate any monopoly power the ESCO might otherwise hold. Moreover as the involvement of ESCOs in emerging markets develops, more work will be done by operators to introduce codes of conduct and provide consumers with reassurance that ESCOs’ dominance of the market will not be abused. [6]

As with any innovative business in an emerging market ESCOs face additional entry barriers or risks as there is often no clear legal framework to govern them. ESCOs are hard to define and governments have trouble deciding whether they are equipment sale businesses, financing businesses or service businesses, which can create significant challenges at start-up, especially in highly regulated systems (which describes many emerging market countries). These problems, coupled with weak legal frameworks, can create difficult situations – it can result in the creation of insecure contracts which cannot be enforced equitably (or at all!) and has resulted, in some cases, in non-payment to the ESCO. [7] For this reason it would be prudent for an ESCO to consider both practical risk-mitigation measures (eg financial guarantees) and legal ones (though the drafting of robust, enforceable contracts containing impartial dispute resolution mechanisms).

Despite these risks the emergence of ESCOs in emerging markets represents a very exciting development for the mobile telecoms industry. They can provide the ability and expertise to manage and control power costs and seem to represent the next stage of the market’s development. They may even act, in many cases, as a stepping-stone to the development or expansion of a national electricity grid system.

Mike Conradi is a partner in DLA Piper’s Intellectual Property and Technology team, focussing on providing commercial and regulatory advice to businesses in the telecoms sector. He has a particular interest in regulatory matters, telecoms and IT outsourcing and in telecoms infrastructure projects, and is one of the firm’s lead partners on non-contentious telecoms matters.

[1] Tower Power Africa: Energy Challenges and Opportunities for the Mobile Industry in Africa, Green Power for Mobile, GSMA September 2014 http://goo.gl/aYZadt

[2] ESCO Solutions, E-on – https://www.eonenergy.com/for-your-business/community-energy/esco-solutions

[3]Tower Power Africa GSMA September 2014

[4] Liberating the power of Energy Services and ESCOs in a liberalised energy market, Paolo Bertoldi Mark Hinnells, and Silvia Rezessy http://iet.jrc.ec.europa.eu/energyefficiency/sites/energyefficiency/files/id184_bertoldi_final.pdf

[5]Tower Power Africa GSMA September 2014

[6] Tower Power Africa: Energy Challenges and Opportunities for the Mobile Industry in Africa, Green Power for Mobile, September 2014

[7] Energy Service Companies (ESCOs) in Developing Countries, Jennifer Ellis, May 2010

Read more about:

DiscussionAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)