The global smartphone market may have bottomed outThe global smartphone market may have bottomed out

The latest numbers for the global smartphone market suggest it has hit an inflection point after years of decline.

November 3, 2023

The latest numbers for the global smartphone market suggest it has hit an inflection point after years of decline.

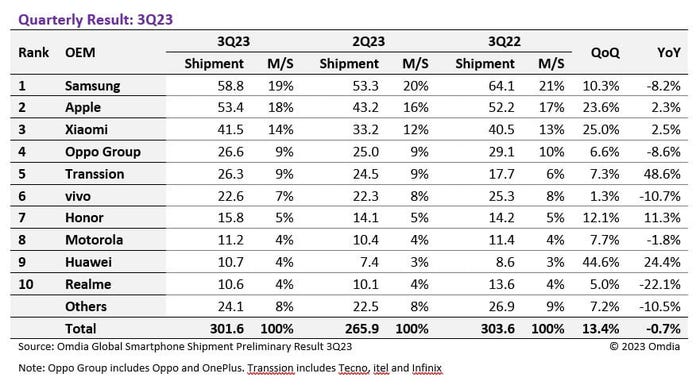

It’s not time to break out the bubbly just yet, but Omdia’s preliminary Q3 2023 global smartphone shipment numbers show a year-on-year decline of just 0.7%. Furthermore, the 301.6 million units shipped mark a 13.4% increase on the previous quarter. That figure needs to be viewed in the context of seasonality, with Q3 nearly always stronger than Q2.

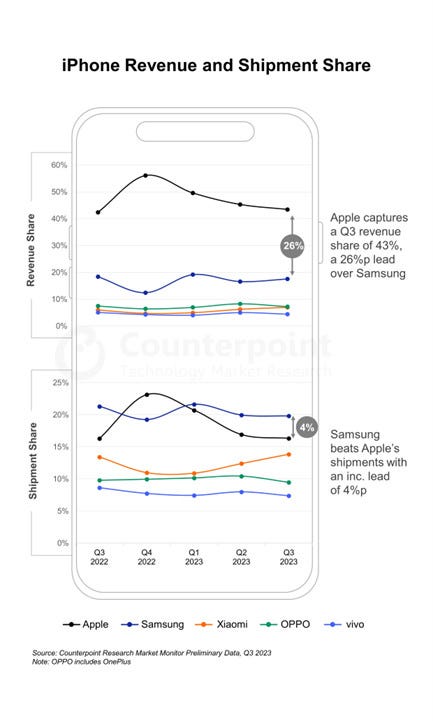

Despite continued macroeconomic gloom, the premium end of the market seems to be a primary driver of this potential rebound, with Apple reporting strong numbers. “Today Apple is pleased to report a September quarter revenue record for iPhone and an all-time revenue record in Services,” said Tim Cook, Apple’s CEO. “Our active installed base of devices has again reached a new all-time high across all products and all geographic segments, thanks to the strength of our ecosystem and unparalleled customer loyalty,” said Luca Maestri, Apple’s CFO.

Counterpoint took the opportunity to reiterate how exceptionally profitable Apple is too. “Pro Max being the best-selling variant of the iPhone 15 series contributed to Apple also achieving its highest-ever Q3 operating profit,” said Harmeet Singh Walia of Counterpoint. “However, its global smartphone operating profit share remained flat due to a resurgence of Huawei and Honor, and an increased focus on profitability by other Chinese OEMs such as Xiaomi and Oppo. Consequently, the global smartphone operating profit reached an all-time high, signaling more definitely how the smartphone market has adjusted to the post-pandemic trend of lower shipments.”

Another driver was Chinese manufacturer Transsion. “Transsion Holdings’ rise has come after a long period of stagnation, as it was digesting the inventories from 1Q23, and as consumers had less money to spend,” said Zaker Li of Omdia. “But clearly Transsion is very ambitious going into 2024, rapidly expanding its production plan. This shows that its efforts to expand into more markets could be proving successful.”

The broader market trend is put into perspective by the chart below from Canalys, which released its Q3 numbers a couple of weeks ago and subsequently reflected on Huawei’s smartphone renaissance. Extrapolating the current trend would see the market returning to growth for the first time since early 2021 in the next quarter. Having said that, it still has a long way to go to hit the heights of 2017, when annual global smartphone shipments topped 1.5 billion.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

Read more about:

OmdiaAbout the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)