Ericsson shares jump after another quarter of quietly delivering the numbersEricsson shares jump after another quarter of quietly delivering the numbers

At first glance Ericsson’s Q2 2018 numbers don’t look all that great, but they’re clearly better than investors expected because its shares have jumped.

July 18, 2018

At first glance Ericsson’s Q2 2018 numbers don’t look all that great, but they’re clearly better than investors expected because its shares have jumped.

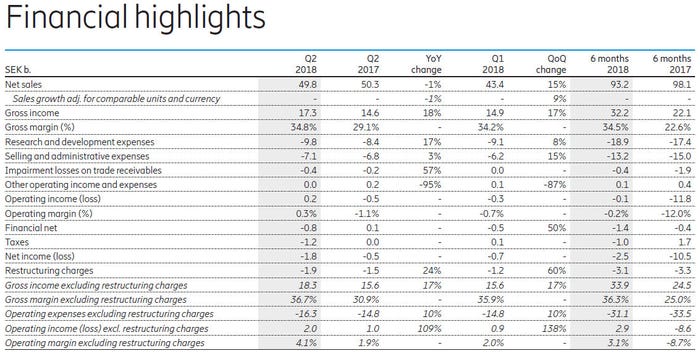

Net sales were down 1% year-on-year to SEK 49.8 billion. And Ericsson’s quarterly loss increased to SEK 1.8 billion. But Ericsson and, apparently, its investors, are more interested in things like gross margin and operating income. Gross margin was up to 34.8%, cementing the positive trend initiated in the previous quarter. Operating income was in the black at SEK 0.2 billion, versus an expected loss of SEK 0.1 billion, which equated to an operating margin of 0.3%. Ericsson’s shares were up 10% in pre-market trading.

“We continue to execute on our focused business strategy and are tracking well towards our 2020 target of an operating margin of at least 10%,” said Ericsson CEO Börje Ekholm. “The investments in technology leadership have resulted in increased gross margin to 37% and growth in segment Networks.

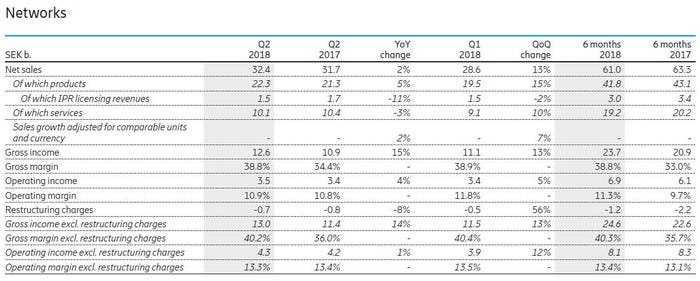

“Customers turn to new technology in order to manage growing demand for data with sustained quality and without increasing costs. This, together with fixed wireless access, represent the first business cases for 5G… We have good market traction in Networks, with a sales growth of 2%, particularly in North America where all major operators are preparing for 5G.”

Network sales in North America have always been critical to Ericsson. A slump in network spending by US MNOs was one of the main reasons behind the protracted slump that led to the major rethink Ericsson reckons it’s only just reaping the rewards of. It’s also a relatively soft market thanks to the hostility of the US state towards Chinese vendors and having their former CEO running one of the biggest operators is presumably quite handy too.

We spoke to Ericsson marketing boss Helena Norrman and she confirmed that the upturn in North America is considered pretty significant within the company, but the big one is the overall networks division. That grew by 2% year-on-year, which was apparently the first quarter of annual growth since Q4 2015.

“There is momentum in execution and also in customer discussions – especially in networks,” said Normann. “Were doing what we said we would do.” By this she was referring to the boring but vital business of cutting costs, improving margin and just doing the day job properly. This isn’t a very exciting narrative, but at the end of the day it’s the only thing that matters.

We were quick to criticize Ekholm when he initially appeared to lack big strategic ideas. A cunning plan was eventually unveiled but the bad newscontinued and by the start of this year there was little evidence of things improving. Unperturbed my moaning journalists Ekholm persisted with his unexciting strategy of just doing the basics better and this now seems to be paying off.

At the end of the day it all comes down to your numbers, especially for public companies. Last quarter’s numbers suggested a possible turnaround and now a second quarter of positive movement on things like margin allows people to think this may be a more durable recovery. So right now Ekholm’s strategy is vindicated but he doesn’t need us to remind him that you’re only as good as your last quarter.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)