Used smartphone market expected to boom

IDC estimates suggest buying used or refurbished phones as opposed to a brand new unit is proving increasingly attractive to many.

January 9, 2023

IDC estimates suggest buying used or refurbished phones as opposed to a brand new unit is proving increasingly attractive to many.

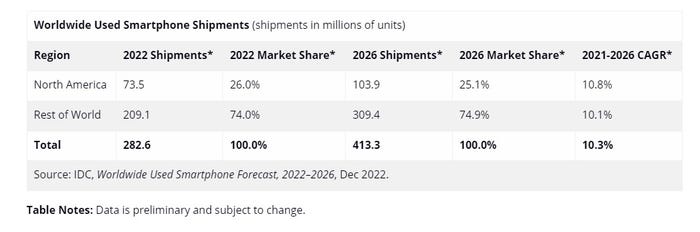

The firm reckons there were 282.6 million used smartphones, including refurbished units, shipped (re-shipped, surely) in 2022, representing an 11.5% increase over the 253.4 million units shipped in 2021. This growth is expected to continue to the point that 413.3 million units will be shipped in 2026, driving a compound annual growth rate (CAGR) of 10.3% from 2021 to 2026 and representing a market value of $99.9 billion.

We’re told trade-in programs are the driving factor for the new and used smartphone market globally, with the launch of several new programmes in regions where trade-in is still a new concept for local consumers.

In ‘mature markets’ – the report cites the US, Canada, and Western Europe – trade-in schemes continue to play a significant role in speeding up refresh cycles through telco and retail-driven promotions, apparently. This has contributed to an increase in trade-in value (TIV), which is pushing prices up in the secondary market ‘due to consumers getting more for their old devices to help drive upgrades.’

Of course many are still happy to dash out and buy the latest devices, especially iPhones, and IDC says the increased sale of higher-priced devices in the new market has created a ‘circular effect’ as many trade-in deals feature primarily on premium devices. However, IDC questions how long these ‘aggressive trade-in offers’ will carry on, since ‘eventually narrow margins will impact the overall profits of the channel, vendor, or perhaps both.’

“The used market was able to grow 11.5% in 2022 thanks to the 6.1% rebound we witnessed in the new market for 2021,” said Anthony Scarsella, research manager with IDC’s Worldwide Quarterly Mobile Phone Tracker. “Used devices demonstrate more resilience to market inhibitors than new smartphone sales as consumer appetite remains elevated in many regions. Attractive price points are critical for growth as cost savings remain the primary benefit. However, a high-end inventory struggle due to elongated refresh cycles in the new market has used prices growing over 11% in 2022.”

Since the cost of living crisis kicked in you can see why it would be hard for many to justify a brand new phone if there are other options available, especially since new models don’t exactly change dramatically from one year to the next.

There were some examples of tech firms trying to wow the crowds with something new at CES last week, most notably the Samsung Flex Hybrid that is foldable and extendable, as well as some models with satellite connectivity. There have previously been other attempts to break the black rectangle mould, such as making it transparent, but nothing has really taken the world by storm as yet. How many people will be queuing around the block to get their hands on the next wave of foldable, invisible, or slidable, or satellite-connected blowers remains to be seen.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)