Ericsson takes $3 billion hit on Vonage acquisitionEricsson takes $3 billion hit on Vonage acquisition

Swedish kit vendor Ericsson has announced a non-cash impairment of SEK 32 billion (around $3 billion) in Q3 2023, ‘relating to the impairment of goodwill attributed to the Vonage acquisition.’

October 12, 2023

Swedish kit vendor Ericsson has announced a non-cash impairment of SEK 32 billion (around $3 billion) in Q3 2023, ‘relating to the impairment of goodwill attributed to the Vonage acquisition.’

This comes roughly a year after the $6.2 billion purchase of the cloud and API specialist, a move central to its ambitions to start selling network APIs and development of a Global Network Platform (GNP).

The announcement states: “The impairment charge represents 50% of the total amount of goodwill and other intangible assets attributed to Vonage. The impairment will be reported in segment Enterprise as an item affecting comparability… The impairment is a consequence of the significant drop in the market capitalization of Vonage’s publicly traded peers, increased interest rates and overall slowdown in Vonage’s core markets.”

In other words, the value of the Vonage unit has been halved. Regardless, Ericsson insists the impairment does not alter its positive outlook on the GNP market potential, and it expects the first revenues from network APIs during 2023.

“Vonage remains key to Ericsson’s strategy to expand in Enterprise. The Enterprise strategy is underpinned by the development in the third quarter in which Ericsson announced an important milestone with a major commercial partnership in its GNP business. The development of GNP is creating a new market for exposing 5G capabilities through network APIs and the market opportunity is estimated at USD 20 billion by 2028 by telecom consultancy and research firm STL Partners. This market will open up new ways for operators to monetize their investments in networks from enterprises and in turn drive further investments in mobile infrastructure.”

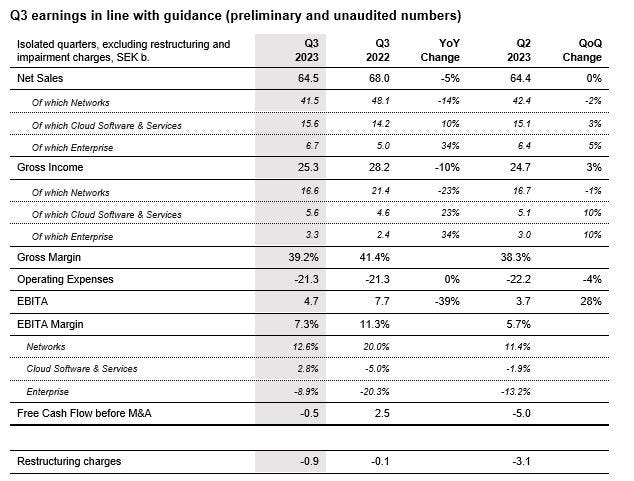

The firm also announced its preliminary and unaudited numbers for Q3 – which included a 60% drop in ‘networks organic sales’ in North America, and a ‘group organic sales’ decline of 10%.

Since the RAN market in general is spluttering at the moment, generating a supplementary revenue stream to the core business of telecoms hardware with APIs may eventually prove to be a good move for Ericsson. The idea that the key to monetisation of 5G and beyond may be down to providing a novel suite of network tools is not without its proponents elsewhere in the telecoms industry. But surely this news at least signifies that Ericsson significantly overpaid for Vonage.

Questions were asked at the time of the purchase with regard to the amount of cash Ericsson was prepared to throw at the deal, and shares dropped 3% after the news. This impairment can be seen as validation of this initial eyebrow raising, whatever the scale of opportunities in the API market turns out to be in the long term.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)