US data reinforces bullish cloud market sentiment

Growth in the US cloud infrastructure services market remained strong in Q3, calming concerns around disappointing numbers from the hyperscalers.

November 1, 2022

Growth in the US cloud infrastructure services market remained strong in Q3, calming concerns around disappointing numbers from the hyperscalers.

When Amazon joined Microsoft and Google in disappointing investors with its outlook, the temptation was to join the dots and conclude the previously booming enterprise cloud market was set for a significant downturn. After all, those three companies account for around two thirds of the overall market and it seemed fair to assume it would be subject to the same headwinds as the rest of the global economy.

But then analyst firms started publishing numbers that painted a more optimistic picture. Specifically Gartner forecast accelerated cloud growth next year and Synergy noted heathy growth in the most recent quarter. They seemed to agree that the disappointing hyperscaler earnings were, at least in part, due to some exceptional factors and that when those were accounted for the underlying picture, for their cloud divisions at least, remained healthy.

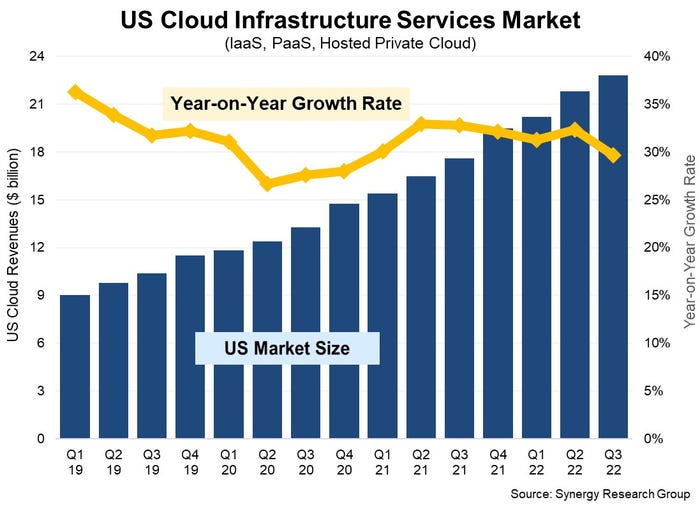

Now Synergy has followed up with another set of numbers focusing specifically on US enterprise spending on cloud infrastructure services. The data point this latest report is most keen to highlight is that in the third quarter of this year that number grew by 30% year-on-year, which is more or less in the middle of the recent historic growth range.

“Given some of the exceptional circumstances facing markets at the moment, it is important to have a handle on drill-down details in order to better understand the underlying trends and how they might impact future market growth. In this case an analysis of the US cloud market is enlightening,” said John Dinsdale, a Chief Analyst at Synergy Research Group.

“US spending on cloud services is now approaching a $100 billion annual run rate and continues to grow by 30% per year, which is pretty unusual for such a large IT market. The growth rates for regional cloud markets beyond the US will bounce back as some of the current exceptional circumstances work their way through the system. This helps to underpin Synergy’s cloud forecasts which continue to show strong growth over the next five years.”

Unsurprisingly the big three US hyperscalers are even more dominant in their home market, accounting for 76% of cloud spending there, according to Synergy. Its latest report insists that focusing on the US market also performs the function of stripping out some exceptional factors, such as a strong dollar and a Chinese market still hamstrung by a ludicrous ‘zero-Covid’ policy, thus revealing the underlying health of the global cloud market.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)