Ofcom rejects Three’s pleas for spectrum socialismOfcom rejects Three’s pleas for spectrum socialism

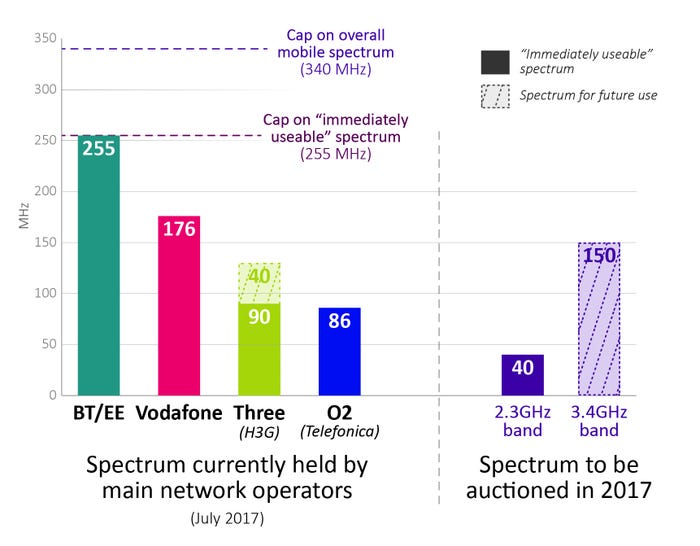

UK telecoms regulator Ofcom has published its long-awaited decision on the upcoming 2.3 GHz and 3.4 GHz bands, and Three is not happy.

July 11, 2017

UK telecoms regulator Ofcom has published its long-awaited decision on the upcoming 2.3 GHz and 3.4 GHz bands, and Three is not happy.

The main issue in question wasn’t the mechanics of the auction itself, but rather the matter of how much spectrum each mobile player should be allowed to have. Three has long argued that the spectrum situation in the UK is imbalanced with, coincidentally enough, Three not having enough of it. The fact that most of this spectrum, bar the stuff Three was given when it formed, was acquired in fair and open auctions doesn’t seem to mitigate Three’s righteous indignation.

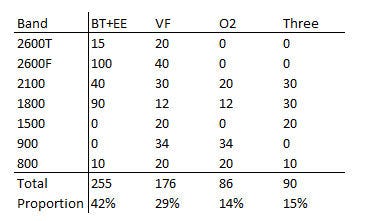

Three wants there to be a cap of 30% of available spectrum owned by any one company. EE/BT currently owns 42% of usable spectrum (see table) so such a ruling would require stripping it of a hell of a lot. It would also severely restrict Vodafone’s participation in future spectrum actions. Three is, in effect, asking Ofcom to embark on a campaign of aggressive spectrum wealth redistribution.

Ofcom seems have resisted any Marxist inclinations it may have and decided to chart a middle ground, as indicated last year. It has placed a cap of 255 MHz of immediately usable spectrum, which includes 2.3 GHz and means EE won’t be able to bid for any of the 40 MHz of it on the table. Ofcom has also imposed a cap of 340 MHz on the overall amount of spectrum owned by any one company after the auction of 150 MHz of 3.4 GHz spectrum (37% of the new total, also including yet-to-be auctioned 700 MHz spectrum), meaning EE will be able to win no more than 85 MHz of it.

So far so good for EE. The company never expected to have much of a shout at the 2.3 GHz band and as you can see from the table it already has plenty of spectrum at similar frequencies. The thing EE’s Ofcom lobbyists will be looking for urgent clarification on, however, is the status of the cap when the 700 MHz becomes available.

EE has very little low frequency spectrum, which is especially handy for rural coverage, and would presumably want to get as much 700 as possible. If the cap is going to remain in place for that, EE is likely to be reluctant to eat too far into its allowance with 3.4 GHz, which will only be used for 5G anyway.

“Spectrum is a vital resource that fuels the UK’s economy,” said Philip Marnick, Ofcom’s Spectrum Group Director. “We’ve designed this auction to ensure that people and businesses continue to benefit from strong competition for mobile services.”

That’s not how Three sees it. “Ofcom’s proposal is a kick in the teeth for all consumers and in particular for the near-200,000 people who signed up to the ‘Make the Air Fair‘ campaign,” said Three UK CEO Dave Dyson. “By making decisions that increase the dominance of the largest operators, Ofcom is damaging competition, restricting choice and pushing prices up for the very consumers that it is meant to protect. The mobile market is imbalanced and failing customers. Ofcom has shown little interest in tackling the problem. We will consider our response as a matter of urgency.”

Ofcom is not buying this mix of doom-mongering and disingenuous altruism from Three. “”We take all our decisions in the interests of consumers,” said an Ofcom spokesperson in response to Dyson’s statement. “This auction will keep the airwaves fair by reducing the share held by the largest operator. It will include strong safeguards to maintain a healthy four-player market and allow mobile operators to acquire the airwaves they need to compete.”

EE CEO Marc Allera, who must be pretty happy with the outcome, sensibly kept his cards close to his chest on the matter. “While we don’t agree that spectrum caps were necessary for this auction, our focus remains on investing in our network, using our existing and future spectrum to provide the best mobile experience for our customers across the UK. We look forward to bidding for additional spectrum in this auction,” he said.

Kester Mann of analyst CCS Insight also seems to think Three needs to give the moaning a rest. “Three’s immediate response represented a stinging attack on the regulator following months of campaigning for more favourable conditions,” he said. “Spectrum is vital to it turning around its precarious position in the UK and re-energising a disruptive strategy. However, it now needs to push ahead with a bold strategy for the auction and invest strongly to counter criticism from rivals that say it has shied away from previous opportunities.”

Another reason Dyson and Three are failing to receive the sympathy they clearly feel they deserve will be the recent acquisition of UK Broadband, one of the few other companies to own any other UK spectrum. “After acquiring UK Broadband in February, the operator Three has access to 40 MHz of mobile spectrum in the 3.4GHz band, plus 84 MHz in the 3.6 to 3.8GHz band,” said Ofcom in the rationale behind its decision. It also flagged up the 1400 MHz spectrum Three got off Qualcomm a couple of years ago and we understand it views Three’s cash position as strong.

We called Ofcom’s initial statement on this issue a fudge, but in hindsight the middle course seems to be the most sensible option. Three tries to infer that its spectrum position is the result of some intrinsic unfairness in the UK market but the facts just don’t support that. EE won its spectrum at auction fair and square and intervention to reverse that process would set a very worrying precedent for future auctions and the UK mobile market in general.

We have some sympathy for any claim that Orange and T-Mobile should have been required to give up more spectrum as a condition of their merger to form EE but what’s done is done. Three still has plenty of spectrum and the opportunity to get loads more if it splashes the cash for a change. Three’s main response to the Ofcom consultation was to claim it is capacity-constrained but if that’s the case how come it just started offering unmetered Netflix streaming?

Here’s hoping Three will finally realise it’s likely to get more ROI from actually competing rather than moaning, but we’re not holding our breath. Ofcom has summarised the current UK spectrum landscape situation in the table below.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)