Nokia finishes the year on a relative highNokia finishes the year on a relative high

Finnish kit vendor Nokia banked a bit more profit than expected in Q4 2019, to finish a tough year on a slightly positive note.

February 6, 2020

Finnish kit vendor Nokia banked a bit more profit than expected in Q4 2019, to finish a tough year on a slightly positive note.

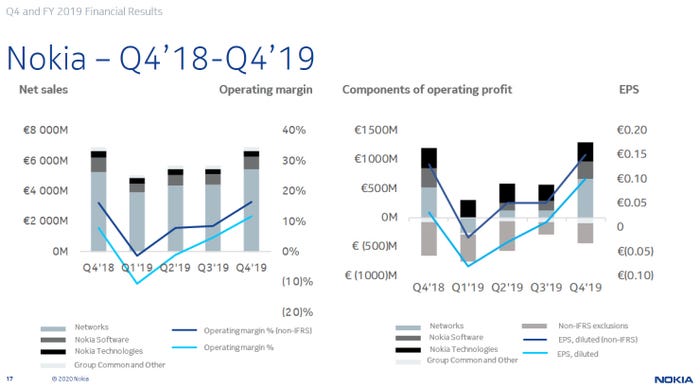

Earnings per share were €0.15, up from €0.13 a year ago, which was apparently what was expected again this time. Nokia seemed pretty pleased with its cashflow too, having significantly topped up its flagging bank balance in the quarter. Shares experienced a minor bump, taking them near the top end of the range they have inhabited since they tanked after a gloomy outlook a quarter ago.

“Nokia’s fourth quarter 2019 results were a strong end to a challenging year. We saw strength in many parts of our business in the quarter, delivered a slightly better operating profit than the same period in 2018, generated solid free cash flow, and increased our net cash balance to EUR 1.7 billion,” said Nokia CEO Rajeev Suri.

“When I look at Nokia’s full-year 2019 performance, we saw good progress in our strategic focus areas of enterprise and software… We recognize, however, that we have faced challenges in Mobile Access and in cash generation. We will have a sharp focus on these two areas over the course of 2020, which we believe to be a year of progressive improvement as the actions we have underway start to deliver results.

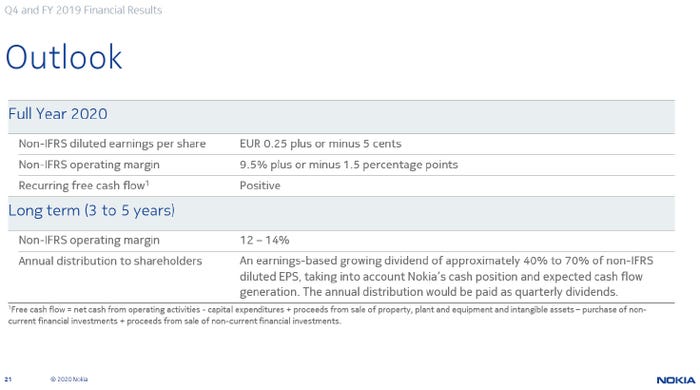

“While I believe that 2020 will present its share of challenges, I am confident that we are taking the right steps to deliver progressive improvement over the course of this year and to position us for a stronger 2021.”

Suri’s words were pretty measured and indicated that it’s still mainly in recovery mode this year, so you can see why investors didn’t get too excited. 4G/5G radio market share outside of China is expected to stabilize at 27% over the course of the year and the current count of 5G deal wins is 66. Once more Nokia’s financial situation feels a bit like Ericsson’s a year or two ago, in so much as it’s all about providing a stable foundation for future growth.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)