Ericsson insists strategy is still on track after another difficult quarterEricsson insists strategy is still on track after another difficult quarter

Shares in Swedish kit vendor took another tumble after it lamented ongoing market uncertainty with no end in sight.

October 17, 2023

Shares in Swedish kit vendor took another tumble after it lamented ongoing market uncertainty with no end in sight.

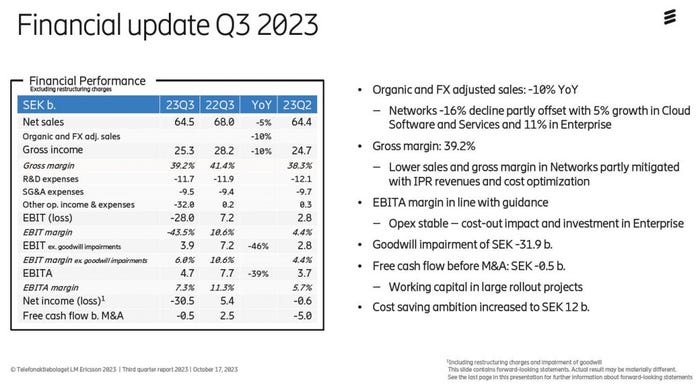

Overall sales were down 10% year-on-year and gross margin was within the historical range. But once you factor in the massive goodwill write-down on the Vonage acquisition, Ericsson had to report a loss of over SEK 30 billion for the quarter. Furthermore the EBITA margin, which Ericsson has long pledged to hit at least 15% by 2024, declined significantly year-on-year. This led the company to effectively concede defeat on hitting that target on schedule, which seems to have been the news that most depressed its share price.

“In a challenging operating environment, Ericsson delivered third quarter results in line with our guidance,” said Ericsson CEO Börje Ekholm in his commentary on the quarterly numbers. “Consistent with the rest of our industry, we expect the macroeconomic uncertainty to persist into 2024, which impacts our customers’ investment ability.

“Last week, we announced a SEK -32 b. impairment of goodwill attributed to our acquisition of Vonage. Since the announcement of our acquisition in 2021, macroeconomic headwinds, including rising interest rates and changing demand trends, have significantly impacted the market capitalization of Vonage’s publicly traded peers.

“Our long-term EBITA margin target of 15-18% remains, and we aim to reach it as soon as possible, subject to market mix recovery. Given current uncertainty we will not give guidance beyond Q4, 2023. As timing for the market mix recovery is in our customers’ hands, we prudently plan for current market conditions to prevail into 2024.”

We spoke to Ericsson’s head of networks Fredrik Jejdling about the numbers and he stressed there were no novel factors influencing the gloomy outlook, so it seems more like Ericsson was hoping things would have picked up a bit more than they have by this stage. Jejdling declined to be drawn when asked if Ericsson had overpaid for Vonage but we find it hard to conclude otherwise, even when allowing for those macroeconomic headwinds.

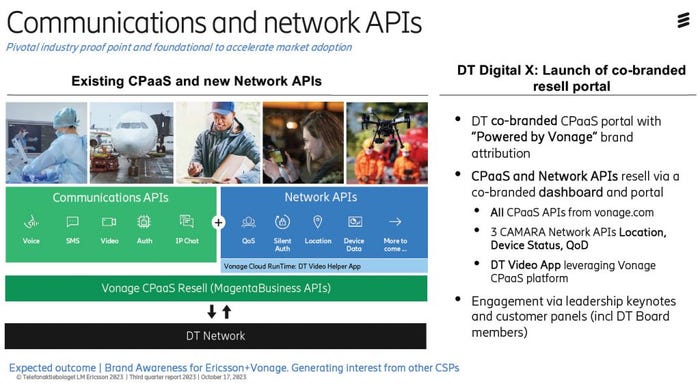

Much of the investor presentation was spent reiterating the case for the Vonage acquisition, specifically citing its recent partnership with DT over network APIs as a proof point. The other technological paradigm Ekholm was keen to stress was Ericsson’s increasing affection towards Open RAN and cloud RAN. Jejdling even made a surprise appearance at the recent Fyuz event to explain Ericsson’s position on the matter and he stressed to us that all of the above are intrinsic to Ericsson’s cunning plan for a global network platform.

Ericsson’s shares were down by over 8% at time of writing but it’s interesting to note they were unaffected by last week’s Vonage write-down news. Does that mean the lower valuation was already priced-in by investors? A bigger concern is the gloomy general macroeconomic outlook, which seems to have dragged Nokia’s shares down by 4% too. Ericsson’s reluctance to guide beyond the next quarter suggests they don’t expect things to pick up anytime soon.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)