Amazon cuts bigger slice out of the content pie

Amazon has announced the launch of Amazon Channels in the UK and Germany to allow Prime members to add channel subscriptions for a monthly subscription fee.

May 23, 2017

Amazon has announced the launch of Amazon Channels in the UK and Germany to allow Prime members to add channel subscriptions for a monthly subscription fee.

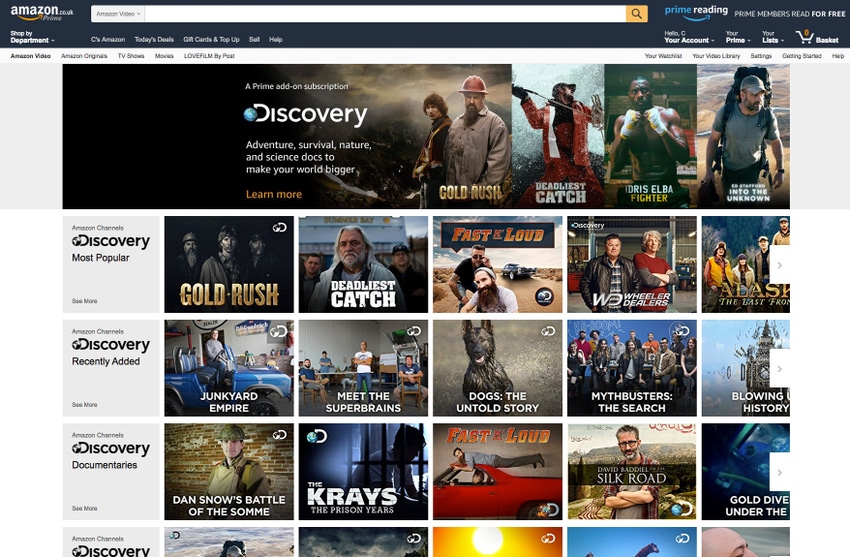

The selling point for the brand will be individual availability of the channels through Prime, without the need to sign up for a bundle or enter a lengthy contract. Amazon Channels available in the UK include Discovery, Eurosport Player, ITV Hub+, hayu, MUBI, BFI Player, MGM, Hopster, Shudder and Heera (Amazon’s own Bollywood channel), amongst others.

“For the first time, Prime members in the UK and Germany will be able to choose to watch premium TV channels without having to sign up to a bundle or a contract, giving them the freedom to pay for only what they want to watch,” said Alex Green, MD for Europe, Amazon Channels.

“From live sport to Bollywood, arthouse cinema to reality TV, and award-winning TV shows from popular channels like Discovery and ITV, Amazon Channels gives power back to customers to choose exactly what they want to watch.”

The big question which should be on the minds of telcos in the UK is how this will impact them? The content market is potentially a lucrative one when you consider the revenue channels which can be developed outside the standard subscription model. The heralded multi-play goldmine is one which pretty much every operator is chasing, but how successful have they been to date?

Sky is probably in the strongest position. It started as a content player, nailed down the position before looking at broadband and, more recently, MVNOs. Through the last couple of years, there have been challenges to disrupt the status quo, BT with sport or Amazon Prime and Netflix for series, but Sky is still top of the pile. A new player in the market has the potential to send ripples throughout the pond once again, but it has a relatively sound foundation with a strong customer base and a solid content offering.

Virgin Media is an interesting one, as the content is a free add-on. Your correspondent is currently a subscriber, and while one should never complain about receiving something for free, the proposition is nothing special. There seem to have phoned it in, put it out there because having a content offering is the thing to do; there’s nothing unique, nothing notable.

A free offer sounds good on the surface, but in reality it probably damages the overall perception of Virgin Media, it certainly does for your correspondent, just because it is so bland and uninspiring. It’s a pity, because the broadband service is alright. A bit slow at times, but nothing to really complain about.

BT is another which has tried cracking the content market with mixed results. The team has spent big on securing sport content over the last few years which has formed the cornerstone of the strategy, but due to the fact it licenses content as opposed to creating and owning, it could be considered in a dubious position. What happens if Sky outbids BT and secures the rights to the Champions League next time? What will the appeal of BT be? Are there enough rugby fans to make it a commercially successful model?

Amazon is a highly successful and influential brand. It has a large customer base already and an aggressive sales strategy; the scale of the current business means cross-selling opportunities will be abundant. Sceptics of the strategy will highlight the success in the US for live TV has been limited, while other might point to Sky nailing down HBO and Showtime content, but the threat is there.

It’s also been spending big on unique content, such as its own version of Top Gear (with the proper hosts), as well as shows like ‘Man in the High Castle’, which creates a new proposition. The risk of the telco slice of the content pie getting smaller is a very real one because they haven’t nailed down their place in the market already.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)