Downbeat outlook fuelled by Huawei situation hits Qualcomm shares

Mobile chip giant Qualcomm delivered solid Q2 numbers but a gloomy outlook thanks largely to the Huawei export ban drove down its share price.

August 1, 2019

Mobile chip giant Qualcomm delivered solid Q2 numbers but a gloomy outlook thanks largely to the Huawei export ban drove down its share price.

Qualcomm’s core numbers were broadly in line with expectations, with revenues a bit below but earnings per share above. But in the ensuing earnings call Qualcomm CEO Steve Mollenkopf warned of a few factors that are likely to negatively affect the company in the coming quarters.

“The Huawei export ban, along with the pivot from 4G to 5G which accelerated over the past couple of months, has contributed to industry conditions particularly in China that we expect will create headwinds in our next two fiscal quarters,” said Mollenkopf. “As a result of the export ban, Huawei shifted their emphasis to building market share in the domestic China market, where we do not see the corresponding benefit in product or licensing revenue.

“In addition, our customers in the China market are working through their existing 4G inventory and deemphasizing their second half 2019 4G launches, as they shift their priorities to their 5G launches in early 2020. As a result, we do not expect the typical seasonal benefits given this unique market dynamics. For the first calendar quarter of 2020, we anticipate reaching the inflection point as our financial results begin to reflect the benefits of our substantial efforts over the years to bring 5G to the market worldwide.”

The reason Huawei’s increased emphasis on China is to Qualcomm’s detriment is two-fold. Huawei presumably uses its own chips in devices it sells within China, so Qualcomm doesn’t have a piece of that action. It does, however, sell components to the other Chinese smartphone makers, so any increase in competitive pressure from Huawei will affect Qualcomm’s revenues from sales to them.

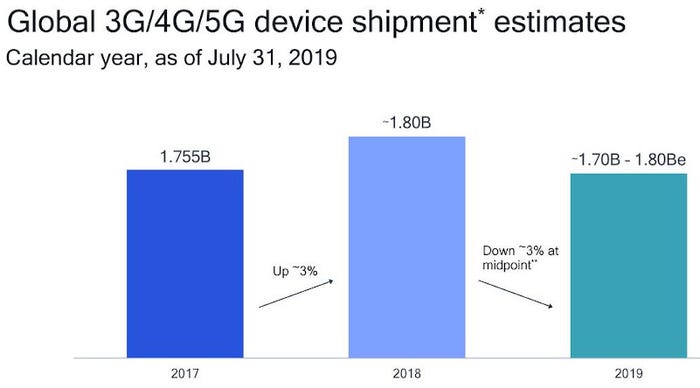

Compounding this is a general softness observed in the Chinese market, which Qualcomm seems to mainly attribute to a lull before the 5G storm. It looks like the channel is trying to reduce the amount of 3G/4G inventory ahead in anticipated demand for 5G devices. As a result Qualcomm has reduced its expectations for global connected device shipments this year by around 100 million.

In the longer term Qualcomm still feels pretty bullish, largely on the back of its claimed 5G modem leadership. Qualcomm reckons the Huawei 5G modem is at least 50% bigger than its one and, of course, Intel’s efforts turned out to be a complete bust. It’s hard to argue with this conclusion so, while Qualcomm’s shares were down 6% in pre-market trading at time of writing, its long term modem prospects still look pretty healthy.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)