Visa drops $5.3 billion on Plaid in bid to future proof itself

Financial services giant Visa is acquiring fintech app enabler Plaid in an apparent bid to ensure it doesn’t get left behind in the app economy.

January 14, 2020

Financial services giant Visa is acquiring fintech app enabler Plaid in an apparent bid to ensure it doesn’t get left behind in the app economy.

Despite the $5.3 billion price tag, few people will have heard of Plaid. That’s because its sole function is to act as the plumbing in linking together apps with bank accounts, mainly in the US. It’s easy to assume that Visa and Mastercard already controlled nearly all of this but it seems not, with a quarter of Americans using Plaid to link their bank accounts with apps such as Venmo.

“We are extremely excited about our acquisition of Plaid and how it enhances the growth trajectory of our business,” said Al Kelly, CEO of Visa. “Plaid is a leader in the fast growing fintech world with best-in-class capabilities and talent. The acquisition, combined with our many fintech efforts already underway, will position Visa to deliver even more value for developers, financial institutions and consumers.

“This acquisition is the natural evolution of Visa’s 60-year journey from safely and securely connecting buyers and sellers to connecting consumers with digital financial services. The combination of Visa and Plaid will put us at the epicenter of the fintech world, expanding our total addressable market and accelerating our long-term revenue growth trajectory.”

“Plaid’s mission is to make money easier for everyone, and we are excited for this opportunity to continue delivering on that promise at a global scale,” said Zach Perret, CEO and co-founder of Plaid. “Visa is trusted by billions of consumers, businesses and financial institutions as a key part of the financial ecosystem, and together Visa and Plaid can support the rapid growth of digital financial services.”

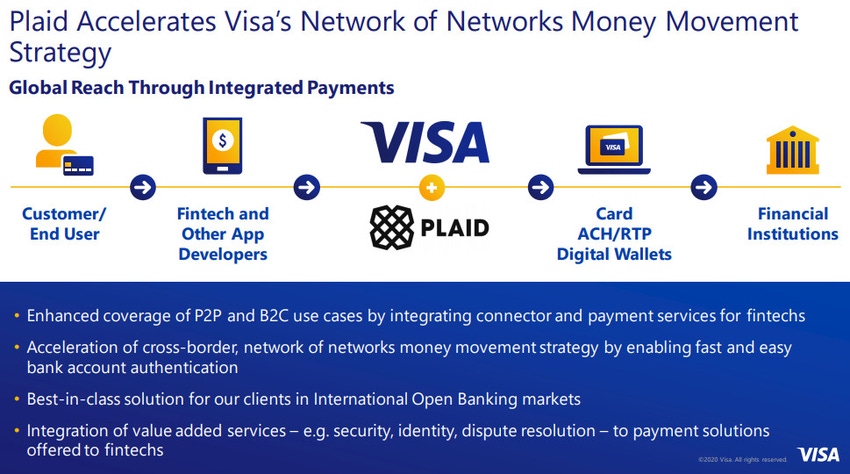

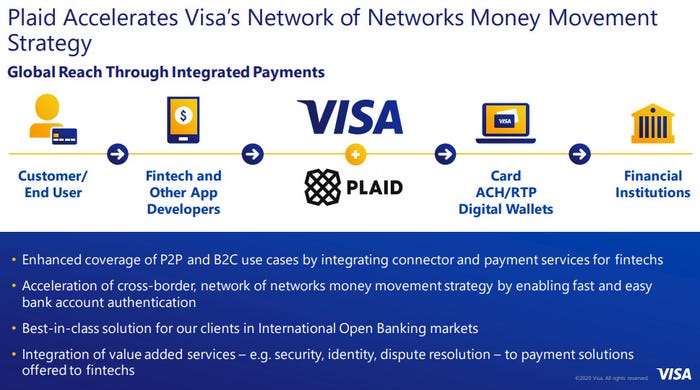

Visa and a bunch of its competitors were early investors in Plaid, so it seems to have the blessing of the financial services establishment. It looks like the price paid was around double the valuation implied by Plaid’s last round of funding, so Visa had to compensate its peers generously to have it all to itself. Investors didn’t seem that bothered either way, however, with Visa’s share price barely acknowledging the news. Here’s a slide from Visa’s presentation summarising the thinking behind the move.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)