Cellcom's acquisition of Golan Telecom still leaves fierce competition in Israel

Cellcom has completed the acquisition of smaller rival Golan Telecom in a deal that will help it to build some scale but is unlikely to address competition issues in the Israeli market.

August 27, 2020

Cellcom has completed the acquisition of smaller rival Golan Telecom in a deal that will help it to build some scale but is unlikely to address competition issues in the Israeli market.

Israel’s largest mobile operator announced it has closed the deal it has been working on for the past six months, ultimately paying 545 million shekels (US$160 million), in addition to adjustments for cash and debt.

Israel’s mobile operators are desperate to consolidate. Indeed, Cellcom went head-to-head with incumbent Bezeq earlier this year in order to secure Golan Telecom, while France’s Altice made a move to acquire Partner Communications via its Israeli telco subsidiary Hot Telecom; the latter deal fell apart for various reasons, including Altice’s reluctance to agree to a termination fee, which would have almost certainly been required given the government’s reluctance to allow more than one M&A deal to go ahead.

On which note, the Israel Competition Authority gave the go-ahead for the Cellcom/Golan Telecom tie-up in June, noting that it would be unlikely to impact on market competition.

Competition is indeed flourishing. Specifically, the authority pointed out that as many as 2 million Israeli mobile customers switch operator every year, which is a huge number when you consider that it represents somewhere between a fifth and a quarter of the country’s population. By way of comparison, in Spain, which is also highly competitive, mobile number portability came in at around 15% last year, according to regulator the CNMC’s figures.

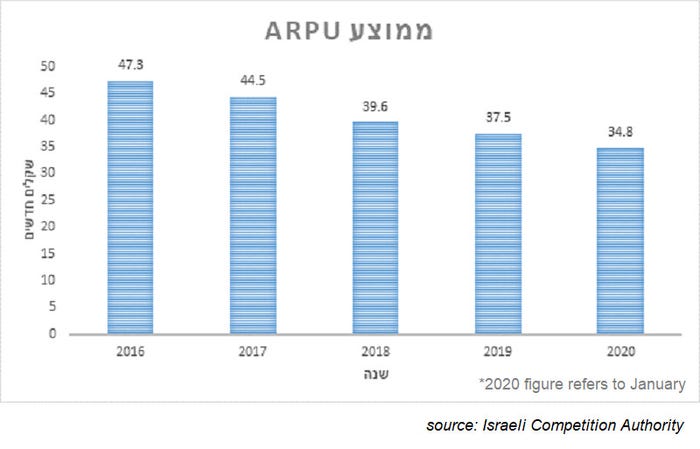

The Israeli government has worked hard to foster strong mobile competition in recent years and as a result prices have fallen – and continue to fall – and mobile revenues are in decline.

Cellcom blamed the Covid-19 pandemic for its revenue slide in Q2 this year, which included an 8.3% year-on-year fall in mobile service revenues, but a look at its most recent annual report shows mobile service revenues have been dropping for the past few years.

In his comments alongside the Q2 report, published last week, Cellcom CEO Avi Gabbay said he expects Golan Telecom to “make a significant addition to the Company’s Adjusted EBITDA and Free Cash Flow.” But the impact of the deal on the broader market might well be negligible.

As the Competition Authority noted, the merger does not reduce the number of network operators in Israel, since Golan Telecom has been operating under a network-sharing deal with Cellcom for the past three years. In fact, a function of the deal saw Golan Telecom’s operating licence replaced by an MVNO licence for an interim period, at the behest of the regulator. It seems that Golan Telecom will remain as a separate entity, albeit controlled by Cellcom.

The authority said it also looked at the issue of price rises as a result of the merger and concluded that there was no reason for concern, the market will remain competitive.

Israel auctioned off its first 5G frequencies earlier this month, selling spectrum in various bands including 700 MHz and 3.5 GHz. However, 5G is unlikely to trigger any serious price rises, at least in the short term.

According to Israeli newspaper Haaretz, in addition to the fact that actual 5G services are still some way off, the operators have made it clear that they do not intend to charge more for 5G, choosing instead to rely on customers’ increased data usage to recoup their costs.

All in all, it looks like Israel’s mobile operators will be living with a revenue squeeze for some time to come.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)