T-Mobile US benefits from Sprint effect in customer net adds

T-Mobile US is crowing about the growth in its customer base over the past year, but appears to be studiously ignoring the effect its acquisition of Sprint has had on the figures.

January 7, 2021

T-Mobile US is crowing about the growth in its customer base over the past year, but appears to be studiously ignoring the effect its acquisition of Sprint has had on the figures.

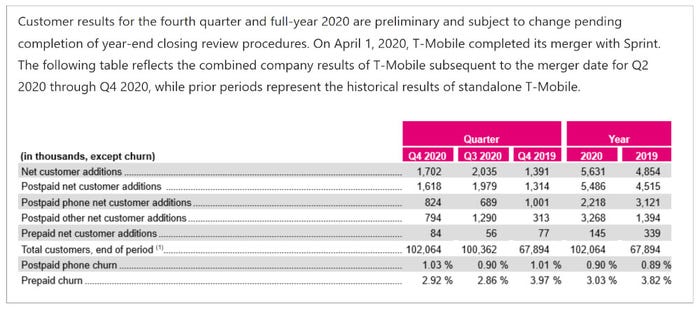

The mobile operator trumpeted postpaid net customer additions of 1.6 million in the fourth quarter and 5.5 million for the full year, declaring the latter “the highest annual number in company history.”

Company CEO Mike Sievert (pictured) issued the usual soundbite-ridden statement we have come to expect from T-Mobile, talking up its “record-breaking results,”its position as “the growth leader in wireless” and so forth, but failed to mention that the company’s numbers had a boost from the acquisition of a fairly sizeable rival. Admittedly, Sprint was struggling to hold on to phone customers by the time the acquisition went through, but its net customer additions were strong thanks to sales of data devices, and T-Mobile’s numbers have likely benefited from that.

T-Mobile did not split out Sprint’s figures, but given that the now subsumed operator recorded around half a million postpaid net adds in both the quarters to the end of December 2019 and end-March 2020, it’s safe to say there was a contribution to T-Mobile’s overall figure. Indeed, T-Mobile’s figures show that postpaid net adds grew by just over 300,000 compared with Q4 2019, but the year-ago quarter does not include Sprint (see chart).

The telco’s postpaid phone net adds were down quarter-on-quarter – 824,000 compared with just above 1 million in Q4 2019 – which is understandable given that Sprint was haemorrhaging phone customers. T-Mobile chose not to particularly highlight its postpaid phone net adds though. Funny that.

Instead its focus was on talking up its position in the market, compared with its rivals.

“In the fourth quarter, T-Mobile is expected to lead the industry again across several key metrics with 1.7 million total net additions, 1.6 million postpaid net additions, and 824,000 postpaid phone net additions,” the operator said. We’ll find out the truth of that statement when AT&T and Verizon share numbers, but it is likely to be correct.

The operator was also keen to share details of its 5G rollout, noting that its Ultra Capacity 5G service, based on 2.5 GHz and mmWave spectrum, covers 106 million people and is expected to hit nationwide coverage by the end 2021. “The 106 million surpassed the company’s aggressive goal to cover 100 million Americans by the end of 2020 and compared to an estimated 2 million people covered by Verizon’s Ultra Wideband 5G, showcasing T-Mobile’s dramatic lead in the 5G race,” it noted.

Telcos – and their PR and marketing teams – are indeed racing when it comes to 5G coverage, but they would do well to remember that while network rollout cannot be as slow as a marathon, it is certainly not a sprint…no pun intended.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)