O2 and Vodafone trade UK 5G spectrum

O2 and Vodafone have entered into a UK agreement to trade spectrum holdings in the 3.4 GHz-3.8 GHz band to create more efficient frequency blocks for 5G rollout.

April 27, 2021

O2 and Vodafone have entered into a UK agreement to trade spectrum holdings in the 3.4 GHz-3.8 GHz band to create more efficient frequency blocks for 5G rollout.

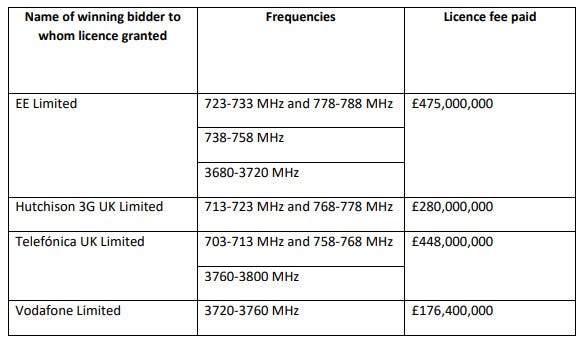

The deal formed part of the assignment phase of Ofcom’s recently concluded 700 MHz and 3.6 GHz spectrum auction, in which it raised £1.36 billion for government coffers. The subsequent assignment phase is now over and added £23 million to the total, Ofcom revealed on Tuesday.

As part of the assignment phase, spectrum winners were permitted to broker trading deals to consolidate their new and existing holdings at 3.4 GHz-3.8 GHz. Vodafone and O2 have done exactly that.

The deal has given O2 a contiguous 80 MHz block, the telco said in a statement, while giving Vodafone “good proximity” of its spectrum blocks in the band, which together total 90 MHz.

“Securing contiguous blocks of spectrum is crucial to harnessing the true power of 5G – we will have the strongest indoor and outdoor connectivity and an ultra-reliable frequency,” said Mark Evans, chief executive of O2.

He followed up his point with a couple of comments about O2’s commitment to customers and customer experience, which don’t really bear repeating. Similarly, Vodafone UK shared a canned comment from CEO Ahmed Essam that focused on how the telco has helped connect NHS workers, job seekers and children doing home school… none of which was really relevant to the deal.

“The results of this auction and our agreement with O2 will help us continue our mission of connecting our customers for a better future,” he added. “It means we have the best possible spectrum to continue giving our customers a fast and reliable 5G service.”

When you cut through all the fluff about who has the best network and whose customers are the most worthy, this deal is about telcos making sure they have the most efficient spectrum portfolio to roll out services. Incidentally, the operators must formally inform Ofcom of their trading deal and await the regulator’s approval, which they are highly likely to get.

Meanwhile, not being part of a trading deal, EE went for a ‘first to market’ response to the end of the spectrum allocation process.

“EE was first to launch 5G, in May 2019, and won 80 MHz overall of the 700 MHz and 3.6 GHz bands that were on offer in the auction,” the telco proclaimed. That’s two years ago, but OK…

Fast-forward to the present and EE says it will be first to use 700 MHz spectrum at a small number of trial locations starting this week and will shortly begin the rollout of its new 3.6 GHz frequencies, reminding us that it has 1 million active 5G customers on its network. It noted that the 700 MHz frequencies will support wider and deeper 5G coverage, including indoors, and will help boost capacity.

“Spectrum is the most vital investment a mobile network can make; the more a network has, the better the experience it can deliver,” said Marc Allera, CEO of BT’s Consumer Division. “We’re pleased to have secured significant new capacity for the EE network at an excellent price.”

He has a point there. As Telecoms.com pointed out when phase one of the auction closed a month ago, the process resulted in the available spectrum selling for only slightly more than the reserve price, with operators paying broadly the same for their new holdings. A relatively sensible auction process is doubtless good news for the telcos, which still have to find the cash for network rollout, and potentially for the market as a whole.

EE though glossed over the fact that it will shoulder the whole £23 million burden from the assignment phase. While its rivals made deals, EE bought itself the position it wanted on the spectrum.

Here’s what Ofcom published offering more detail on the outcome of the auction phase.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)