Insurer Aviva gets in on UK autonomous vehicle project

Aviva is joining a UK autonomous vehicle project in a bid to capture data that will enable it to insure such driverless vehicles when the time comes.

June 4, 2021

Aviva is joining a UK autonomous vehicle project in a bid to capture data that will enable it to insure such driverless vehicles when the time comes.

The firm has agreed a five-year partnership with R&D outfit Darwin Innovation Group, which will initially see it join an existing autonomous vehicle trial at the Harwell Science and Innovation Campus in Oxfordshire.

That campus is also home to Darwin SatCom Lab, which was set up by Darwin and mobile operator O2 last October as a commercial laboratory for 5G and satellite communications. As such, it enables companies like Aviva to test out connectivity solutions for connected and autonomous vehicles, or CAVs, as they seem to be now known.

“It’s encouraging to see the CAV ecosystem grow through this strategic partnership between Darwin Innovation Group and Aviva,” said Sergio Budkin, Director of Business Products at O2, in a statement. He added that O2 is “delighted” to see companies launching trials using CAVs.

This particular announcement doesn’t actually have a lot to do with O2 though. Fresh from its marriage with Virgin Media earlier in the week, the UK mobile operator seems super-keen to make its presence felt across the market, which is what you would expect at this stage of the integration process.

This deal is very much about Aviva, and serves to illustrate just how fundamental the insurance companies will be to the driverless car ecosystem.

“With this trial, we’re able to be there right from the start of the real-life application of autonomous vehicles operating on public roads, which will change not only our relationship with these vehicles but, more fundamentally, how we insure them,” said Nick Amin, Chief Operating Officer at Aviva.

“Autonomous vehicles could change the face of motor insurance within a decade,” Amin said. “Through having access to the data from this trial, we can understand today the kinds of things we’ll have to consider in the future to keep passengers, pedestrians and all other road users safe when driverless technology hits public roads.”

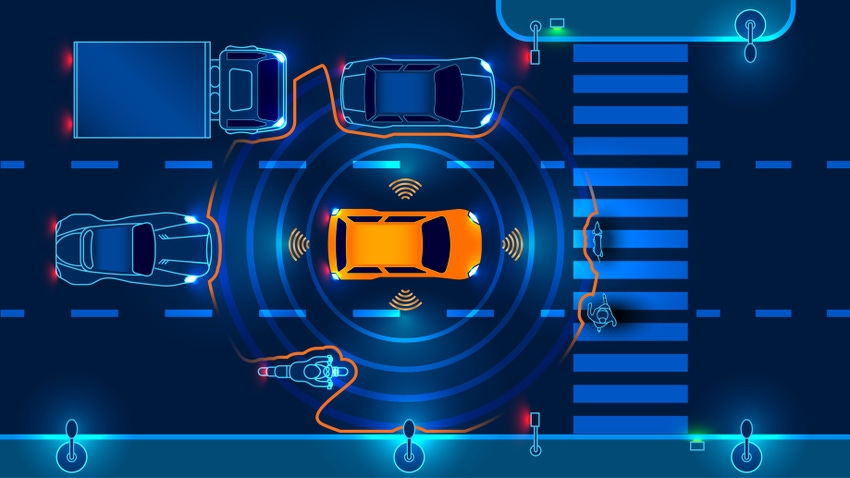

Darwin is trialling a self-driving shuttle, created by French autonomous vehicle specialist Navya, at the Harwell campus. The shuttle is controlled by both 5G and satellite connectivity. It “will be able to pick passengers up, transport them around the campus and drop them off at their destination, all without the involvement of a human driver,” the companies said, which suggests they are not quite at the stage of picking up passengers just yet. A second shuttle will join the trial in the second year of operation, they said, without specifying how long away they expect that to be.

The shuttles do not have a steering wheel and will have a high level of automation. They will have access to all the information they will need to navigate the campus, which Darwin has mapped out in advance. They will also be able to communicate with each other and will have sensors to prevent them running into one another or into other objects.

The shuttles will run for 24 hours a day to enable the triallists to capture data in different light and weather conditions.

All this data will enable Aviva, and likely other insurance companies, to understand the risks and use cases they will have to take into account when designing insurance products for autonomous vehicles.

“For any emergent market to be a success, we need to create an ecosystem of companies who share a vision for innovation and are willing to expand their core competency into something new,” said Daniela Petrovic, Delivery Director at Darwin.

“Emergent markets are usually found at the intersection of industries, and that is why, for the CAV ecosystem to work, we must gather actors from multiple industries to work together,” she said. “The Darwin team are delighted to have Aviva as a partner in this ecosystem, jointly creating new insurance models and enabling CAVs to become mainstream in the UK market.”

Today’s announcement is about Aviva joining the crew. It seems likely there will be more to follow.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)