Non-wireless business propels Nokia to improve outlook

Nokia slightly improved its full-year outlook after delivering a healthy quarter, driven mainly by its network infrastructure and licensing business groups, partly offset by weakness in the mobile networks business.

October 28, 2021

Nokia slightly improved its full-year outlook after delivering a healthy quarter, driven mainly by its network infrastructure and licensing business groups, partly offset by weakness in the mobile networks business.

The Finnish kit maker published its Q3 results, with growth in both income and profit on corporate level. Total net sales grew by 2% year-on-year to reach €5.4 billion ($6.3 billion, €1=$1.16), with gross margin improving by 3.6 percentage points to sit at 40.7%. Operating profit increased by 30% to reach €633 million, giving the company an operating margin of 9.3%, up by 2.7 percentage points from a year ago.

“We delivered another great quarter driven by our increased investments in technology leadership and strong market demand,” said Pekka Lundmark, Nokia’s President and CEO, in the press release. “Overall, I am pleased with our strong financial performance in 2021 so far.” Lundmark continued.

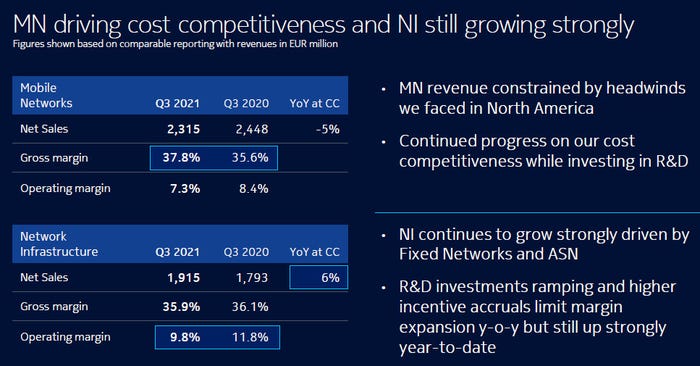

To break down the numbers by business units, however, it is obvious that not all are performing equally well. Mobile Networks, the biggest business unit, which is tasked to turn Nokia’s fortune in 5G, reported a decline in both revenue (-5%) and operating profit (-25%). The companies attributed three factors to the weakness of sales: supply chain constraint, North America (the Verizon deal it lost to Samsung continues to bite), and weak demand for 4G (ironically a result of operators’ aggressive spending on 5G). The decline of operating profit was attributed to increased investment in R&D and higher incentive accruals.

The biggest contributor to profit is Nokia Technologies, the unit responsible for IP, patent, and brand licensing. The unit delivered 45% of the company’s operating profit despite only accounting for less than 7% of sales. The Network Infrastructure (the IP, optical, fixed, and submarine networks) unit grew its quarterly sales by 7%, taking its year-to-date increase in sales to 14%. Its operating profit went down by 15%, which the company attributed to increased spending on R&D. One fruit coming out the aggressive R&D investment to show the world is the recently unveiled FP5 IP routing silicon, which the company claims to be the industry’s most advanced network processor for Service Provider IP networks.

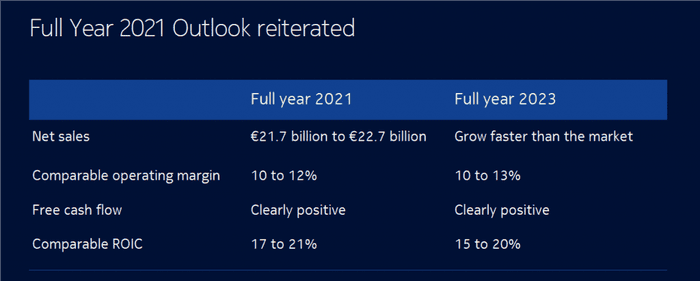

Bolstered by the overall positive results Nokia reiterated its business outlook for 2021 but is now “expecting to be towards the upper-end of our comparable operating margin range,” Lundmark said, though he also warned that “the uncertainty around the global semiconductor market limits our visibility into Q4 and 2022.”

Nokia’s share price went up by more than 5% at one point and is now up by just over 3% by the time of writing.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)