Public cloud growth forecast to accelerate despite everything

Analyst firm Gartner reckons end-user spending on public cloud services will grow by over 20% in what is set to be a turbulent 2023.

October 31, 2022

Analyst firm Gartner reckons end-user spending on public cloud services will grow by over 20% in what is set to be a turbulent 2023.

Nobody thinks next year is going to be easy. The combination of high inflation, geopolitical drama and a continued hangover from the Covid lockdowns is exerting exceptional negative stress on the global economy. But life must go on and there are opportunities for those who choose to be bold when everyone else is on the defensive. Judging from its latest forecast, Gartner seems to think the public cloud market is almost recession-proof.

“Current inflationary pressures and macroeconomic conditions are having a push and pull effect on cloud spending,” said Sid Nag of Gartner. “Cloud computing will continue to be a bastion of safety and innovation, supporting growth during uncertain times due to its agile, elastic, and scalable nature.

“Yet, organisations can only spend what they have. Cloud spending could decrease if overall IT budgets shrink, given that cloud continues to be the largest chunk of IT spend and proportionate budget growth.”

Here’s the full segmented Gartner forecast.

Worldwide Public Cloud Services End-User Spending Forecast (Millions of US Dollars)

| 2021 | 2022 | 2023 |

Cloud Business Process Services (BPaaS) | 54,952 | 60,127 | 65,145 |

Cloud Application Infrastructure Services (PaaS) | 89,910 | 110,677 | 136,408 |

Cloud Application Services (SaaS) | 146,326 | 167,107 | 195,208 |

Cloud Management and Security Services | 28,489 | 34,143 | 41,675 |

Cloud System Infrastructure Services (IaaS) | 90,894 | 115,740 | 150,254 |

Desktop-as-a-Service (DaaS) | 2,059 | 2,539 | 3,104 |

Total Market | 412,632 | 490,333 | 591,794 |

BPaaS = business process as a service; IaaS = infrastructure as a service; PaaS = platform as a service; SaaS = software as a service

Note: Totals may not add up due to rounding. Source: Gartner (October 2022)

“Cloud migration is not stopping,” added Nag. “IaaS will naturally continue to grow as businesses accelerate IT modernisation initiatives to minimize risk and optimise costs. Moving operations to the cloud also reduces capital expenditures by extending cash outlays over a subscription term, a key benefit in an environment where cash may be critical to maintain operations.

“Higher-wage and more skilled staff are required to develop modern SaaS applications, so organisations will be challenged as hiring is reduced to control costs. But since PaaS can facilitate more efficient and automated code generation for SaaS applications, the rate of PaaS consumption will consequently increase.

“Despite growth, profitability and competition pressures, cloud spending will continue through perpetual cloud usage. Once applications and workloads move to the cloud they generally stay there, and subscription models ensure that spending will continue through the term of the contract and most likely well beyond. For these vendors, cloud spending is an annuity – the gift that keeps on giving.”

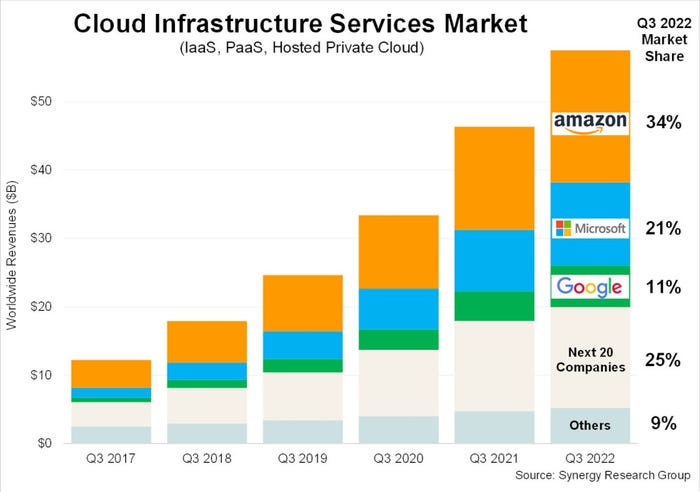

Late last week fellow analyst house Synergy published its quarterly numbers on enterprise cloud infrastructure services spending, which said it exceeded $57 billion in Q3, up 24% on the year-ago quarter. As you can see from the only chart it provided below, Synergy’s numbers aren’t broken down by segment, but it presumably doesn’t include some of the segments Gartner does.

“It is a strong testament to the benefits of cloud computing that despite two major obstacles to growth the worldwide market still expanded by 24% from last year,” said John Dinsdale of Synergy. “Had exchange rates remained stable and had the Chinese market remained on a more normal path then the growth rate percentage would have been well into the thirties.

“The three leading cloud providers all report their financials in US dollars so their growth rates are all beaten down by the historic strength of their home currency. Despite that all three have increased their share of a rapidly growing market over the last year, which is a strong testament to their strategies and performance.

“Beyond these three, all other cloud providers in aggregate have been losing around three percentage points of market share per year but are still seeing strong double-digit revenue growth. The key for these companies is to focus on specific portions of the market where they can outperform the big three.”

For those who fear the near omnipotence of the big three in the technology space, Dinsdale’s comments will make grim reading. While we can’t begrudge them their success, which is based on them offering exceptional business technology outsourcing services, it is ominous that they continue to increase their collective market share. Let’s hope some of these more niche players continue to raise their game.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)