Iliad Italia attracts 10 million customers in five years

Iliad's mobile customer base in Italy has passed the 10 million mark, almost five years after the telco first launched operations.

May 24, 2023

Iliad’s mobile customer base in Italy has passed the 10 million mark, almost five years after the telco first launched operations.

The operator this week announced it had reached doubled figures just days shy of its fifth anniversary on 29 May. While that figure is in itself worth noting, it also reflects a big shift in the Italian mobile market over that same period, triggered by the arrival of the French disruptor.

Iliad has racked up a 12.2% share of the Italian mobile market in its five years in the country, according to end-2022 figures published by regulator Agcom in April. Those numbers refer to human customers and exclude M2M, and represent growth of 1.3 percentage points year-on-year, the regulator said. Meanwhile, its longer-established rivals are gradually witnessing the erosion of their larger market shares. Wind Tre and TIM lost almost a percentage point each over the same period, leaving them at 25.6% and 24.7% respectively, while Vodafone shed half a percentage point to land at 22.6%.

Iliad puts its success down to “innovation, simplicity and transparency,” referring particularly to the lack of hidden costs and guaranteed price plans, as well as trumpeting a 99% customer satisfaction score, based on data compiled by Doxa in March. But that’s essentially a flowery way of saying that Iliad offers cheaper services than its rivals. And that has had a well-documented impact on the broader market.

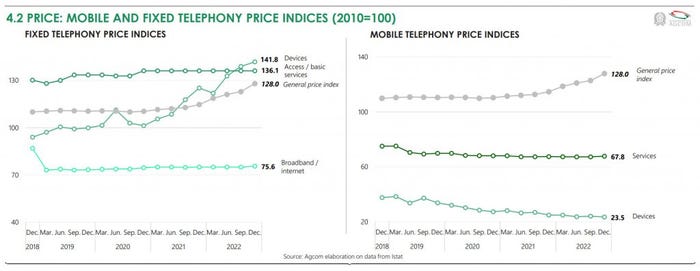

Indeed, Agcom’s latest numbers show a decided downward trend in the price of mobile devices and services over the past few years, even as consumer prices in general have risen (see chart below). And the big operators have made no secret of feeling the pinch from a highly competitive market, which is only just starting to stabilise; TIM reported a trend improvement at its domestic business, despite a continued fall in revenue and earnings in Q1, for example.

But even with its low prices and lock-ins, Iliad’s rising customer base means its financials look pretty healthy.

In the three months to the end of March it posted a 12.6% on-year increase in revenues in Italy to €241 million, while consolidated EBITDAaL grew by more than 61% to €64 million. With capex falling in Q1 versus the same period a year earlier, Iliad Italia turned in a positive operating free cash flow of €5 million, versus a negative €54 million.

At that date, the telco had 9.85 million mobile customers in Italy, plus 131,000 connections to its fibre broadband service, launched early last year. Interestingly, Iliad chooses not to provide mobile ARPU data for its Italian operations, even though it shares that figure for its core French business and its Polish unit. A fairly crude service revenue divided by customers calculation suggests average revenue per users is growing, but without an actual figure, we can’t really make a call on that.

What we can surmise is that Iliad is having a pretty good time in Italy, despite being the smallest of the four MNOs by some margin. Its ability to maintain momentum going forward, particularly against a backdrop of increased convergence, is in some doubt though. We already know that it has held talks with Vodafone – that might well be still going on – regarding a possible tie-up in Italy, and that it has teamed up with market leader Wind Tre to create a wholesale operator that will extend mobile coverage to hard-to-reach areas.

With the Italian market in a state of flux, in no small part due to structural separation plans being enacted by both Wind Tre and TIM, things are likely to change for all players in the not-too-distant future. And it’s a safe bet that Iliad won’t let itself be left behind, however things pan out.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)